Everyone knows that mortgage rates increased in a sudden, dramatic fashion in 2013, but how did that increase end up impacting housing?

It was the most dramatic story to hit housing since the downturn: on May 2, the average mortgage rate for a 30-year FRM was 3.35 percent, just above the record low of 3.31 from Nov. 2012; by July 11, though, improving market conditions – and ill-timed comments by Ben Bernanke that the Fed may stop driving down rates – had produced the sharpest rise in rates since the late ’90s, with 30-year rates finally settling at 4.51 percent.

Even the layman could see how such a rapid increase would impact the housing market (especially when rates had eternally been at record-low levels during the post-bubble marketplace), but how much damage did those mortgage rate increases actually have on the market? Thankfully, new research has given us some insight into that question, and the conclusions are, thankfully, not all that bad.

The Impact of Increasing Mortgage Rates

The research, which was conducted by Deutsche Bank economists Peter Hooper, Matthew Luzzetti and Torsten Slok (and covered by the Wall Street Journal), looked at eight past instances when mortgage rates increased at a rapid rate in a short period of time:

- The overall conclusion of the research was hardly surprising – sharp spikes in rates lead to “extended periods of weakness in housing” that last several quarters.

- The mortgage rate spike of 2013, though, did not compare cleanly to past spikes because of the overall weakness of the present housing market; because so many areas of the housing market are still improving, the rate spikes impacted its fundamentals differently than they had during older, healthier markets.

- That said, the housing market of 2013 performed better than past rate-spike markets in not only new home sales, but also housing starts, building permits and even home price growth.

- So though 2013’s market did see declines – new home sales, for instance, fell 14 percent, while housing starts and building permits stumbled by 5 percent – it did not match the flailing performance of past rate-spike markets.

The Housing Affordability Quandary

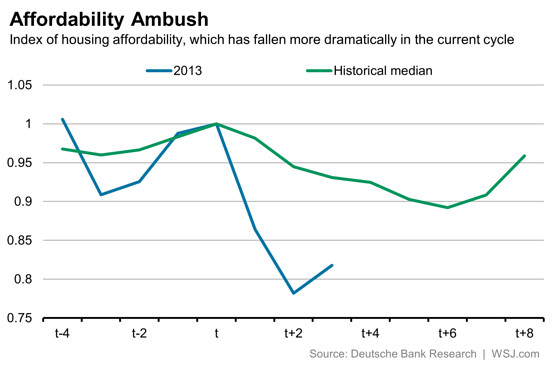

There was one area, though, that suffered dramatically during 2013’s increase in rates, and that was housing affordability. As the Journal‘s graph below demonstrates, that was one area where 2013’s market far exceeded past markets:

How could that be the case? Simply, home prices continued their double-digit yearly returns even after mortgage rates increased, and with prices and rates being the two biggest factors in housing affordability, it would make sense why the measure would take such a hit.

And the affordability trend, the Deutsche economists concluded, will persist: “[Housing affordability] is likely to remain a drag on housing demand as mortgage rates move higher and home prices continue to rise, albeit at a slower pace than over the past two years.”