Roswell leads the pack for initial buyers

According to a recent analysis, three Atlanta suburbs are among the top 100 best cities for first-time homebuyers.

The study, which was conducted by WalletHub, a company that focuses on smart financial decisions, ranked Roswell at No. 31, Sandy Springs 68, and Athens-Clarke 98.

To determine the most favorable housing markets for first-time buyers, WalletHub assessed the real estate landscape within 300 U.S. cities (Atlanta ranked 128). They examined three key dimensions: housing affordability, real-estate market and living environment. Many factors were considered when grading each of the dimensions. Some of these include: violent/property crime rate, median home-price, real estate tax rate and median household annual income. Even though WalletHub recognized Roswell, Sandy Springs, and Athens-Clarke as excellent choices for first-time buyers, certain factors are impacting their ability to actually enter the market.

The Importance of Impressing First-Time Homebuyers

WalletHub reported that the collapse of the housing bubble in 2007 made consumers more skeptical about the homebuying process. That skepticism has affected the percentage of first-time buyers. According to a June 2015 study by the National Association of Realtors, 30 percent of buyers of primary residences were first timers, a drop from 32 percent in May. While that is still a rise from last June 2014’s 28 percent, it is still below the historical average of 40 percent.

Millennials = First-Time Buyers

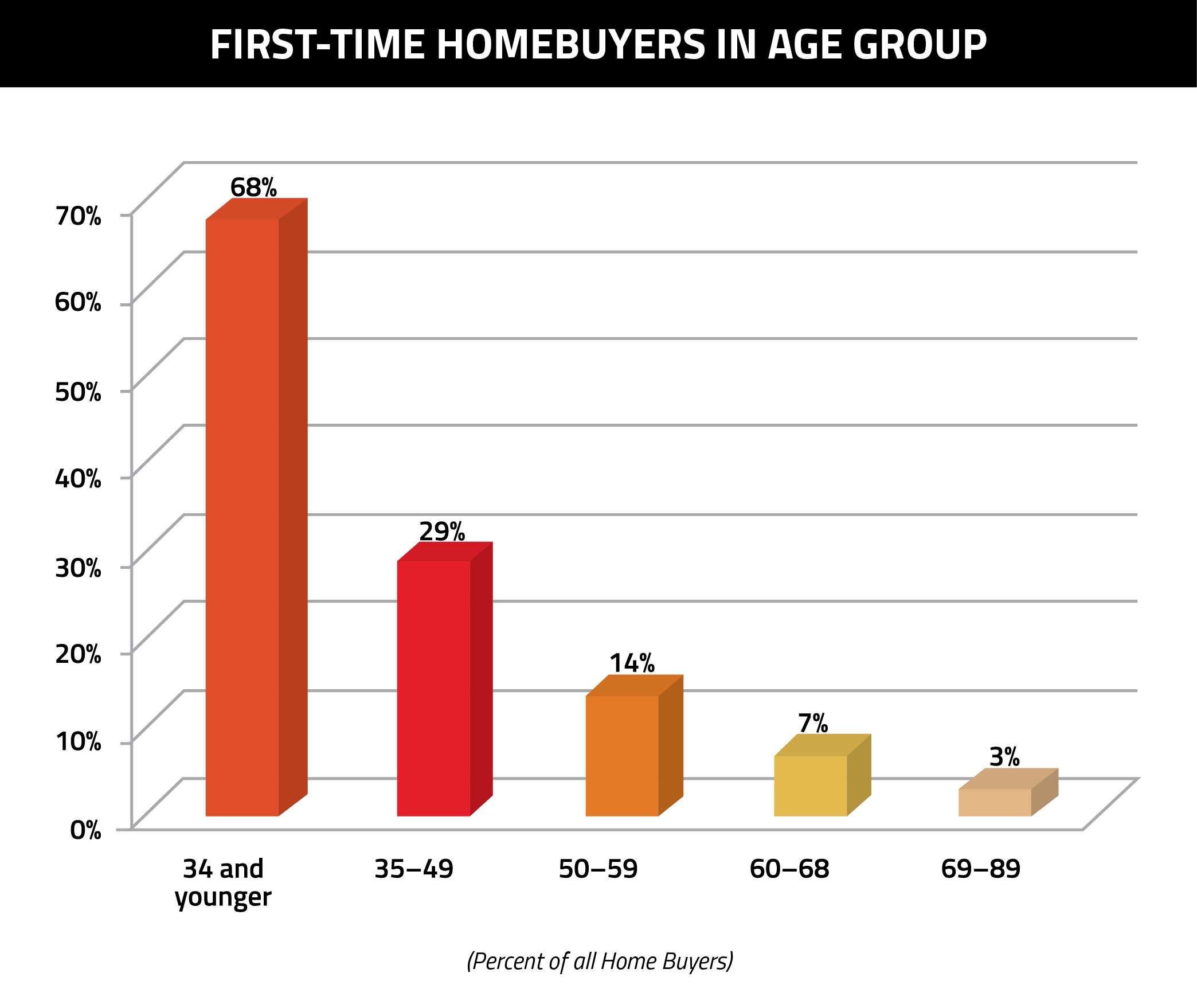

When attempting to sell to first-time homebuyers, it is important to understand that Millennials make up the vast majority of this group. According to NAR’s 2015 Home Buyer and Seller Generational Trend Report, 68 percent of all first-time homebuyers are 34 years old or younger.

While many Millennials desire homeownership, many factors, such as employment and wages, stand in their way of becoming first-time buyers. Even though Millennial employment rates are consistently improving, those advances have not been paired with stronger wages. In 2014, overall wages were only up 2.2 percent, which is basically flat when accounting for inflation. When it comes to Millennials, wages have actually fallen in recent years.

Furthermore, the low wages of Millennials are often coupled with high rates of debt. As Millennials enter today’s workforce, most have some amount of student debt. Since 1993, the average student debt burden has doubled to $33,000. This combination of low wages and student debt is also contributing to the Millennial generation’s low savings rate, further impacting their ability to become first-time buyers.

You misspelled Roswell!!!!

Thank you for bringing that to our attention, Christy!