Bitcoin, the first ever cryptocurrency to function independent of a bank or middleman, soared last month from $5,870.37 per coin on Nov. 12 to $16,650.01 on Dec. 12, a 183.6 percent jump. As of Dec. 21, its value was $15,854.353, and data from Bitstamp reveals that Bitcoin’s market cap has exceeded $293 billion.

Though some analysts caution of a potential crypto bubble, others believe Bitcoin could become legitimate competition for the gold market. Now a percentage of Bitcoin investors, faced with newfound wealth, are focusing their attention on the housing market.

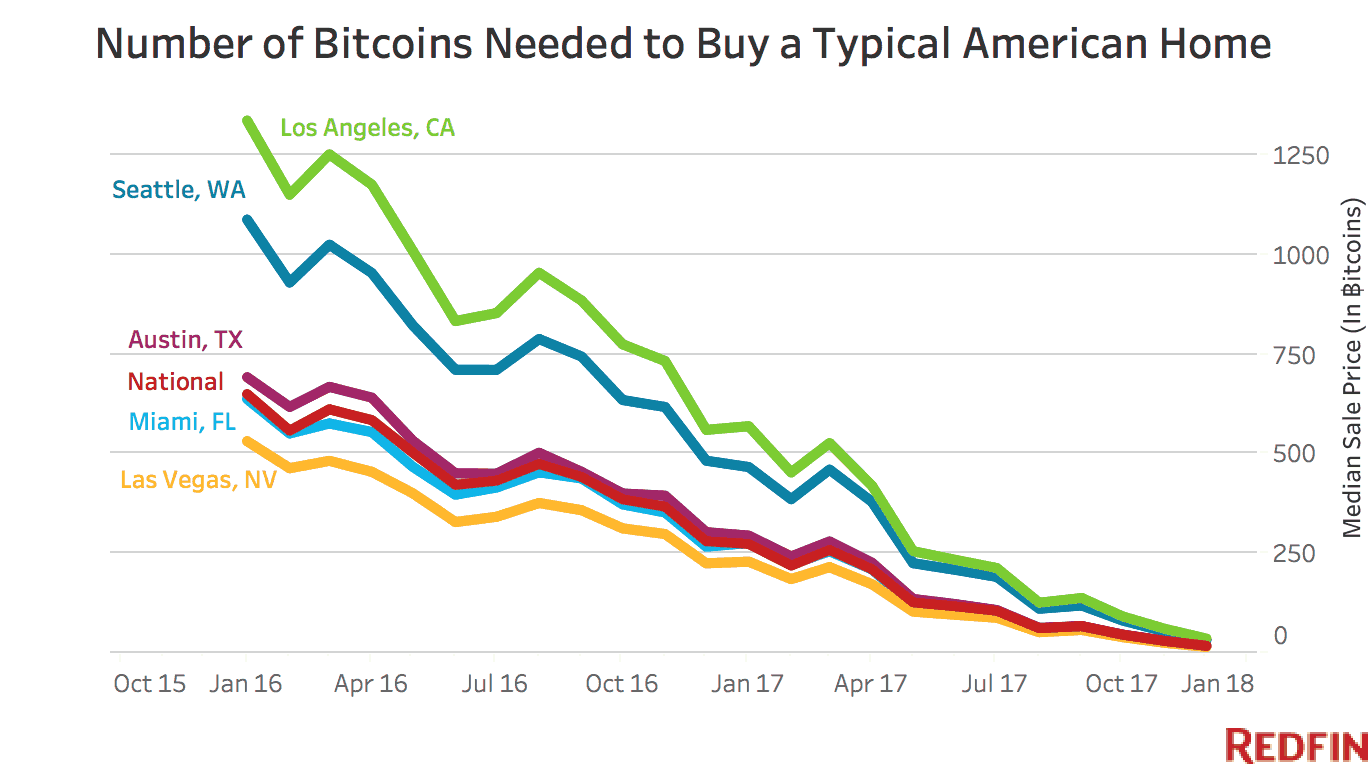

According to Redfin, sellers have mentioned in 75 listings nationwide that they will accept payment in the form of Bitcoin. In November, the median price of an Atlanta home was 13 Bitcoins, or $214,000.

Experts say buyers who use Bitcoin to purchase a house face less risk than sellers, who, when accepting that form of payment, are essentially betting on the value continuing to increase.

“It’s hard to say whether the use of cryptocurrency to buy and sell homes is a long-term trend or just a blip based on the recent spike in value,” said Redfin chief economist Nela Richardson. “In some ways, cryptocurrency investors have just won the lottery, and so it makes perfect sense to buy their dream home. On the other side of the ‘coin’, sellers probably wouldn’t accept lottery tickets as payment.”