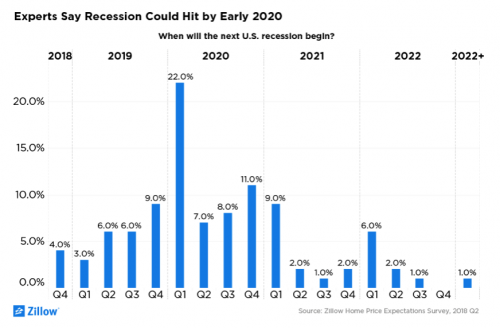

The most recent quarterly survey by Zillow suggests that the U.S. will likely experience another recession come 2020.

Pulsenomics LLC conducted a survey that asked more than 100 real estate experts and economists about their predictions for the housing market, including when the next recession would begin and what would be the cause of it.

Almost half of all experts believe the next recession will begin sometime in 2020. A majority of experts think the likeliest cause to be monetary and trade policy. However, just a few months ago, experts believed that geopolitical crisis would be the cause of the next recession.

“As we close in on the longest economic expansion this country has ever seen, meaningfully higher interest rates should eventually slow the frenetic pace of home value appreciation that we have seen over the past few years, a welcome respite for would-be buyers,” said Aaron Terrazas, Zillow’s senior economist.

However, when it comes to the impact on the residential home market, experts are less concerned. A little more than half of experts surveyed said that today’s mortgage underwriting standards are neither too tight nor too loose. For borrowers with the best credit histories, 70 percent of panelists agree that lending standards are about the same or looser today compared to pre-bubble norms. For borrowers with more typical credit histories, 50 percent of panelists said that credit has gotten somewhat tighter and only 13 percent said it’s gotten easier.

For now, the housing market will likely continue to experience strong appreciation. Experts predict that in 2018, home values will rise 5.5 percent, compared to last year’s prediction of an increase of 3.7 percent, to a median of $220,800.

“Constrained home supply, persistent demand, very low unemployment, and steady economic growth have given a jolt to the near-term outlook for U.S. home prices,” Terry Loebs, Pulsenomics founder, said. “These conditions are overshadowing concerns that mortgage rate increases expected this year might squash the appetite of prospective home buyers.”