Two recent reports from the National Association of REALTORS® examine the challenges faced by today’s homebuyers from both the consumer’s and the Realtor’s perspective.

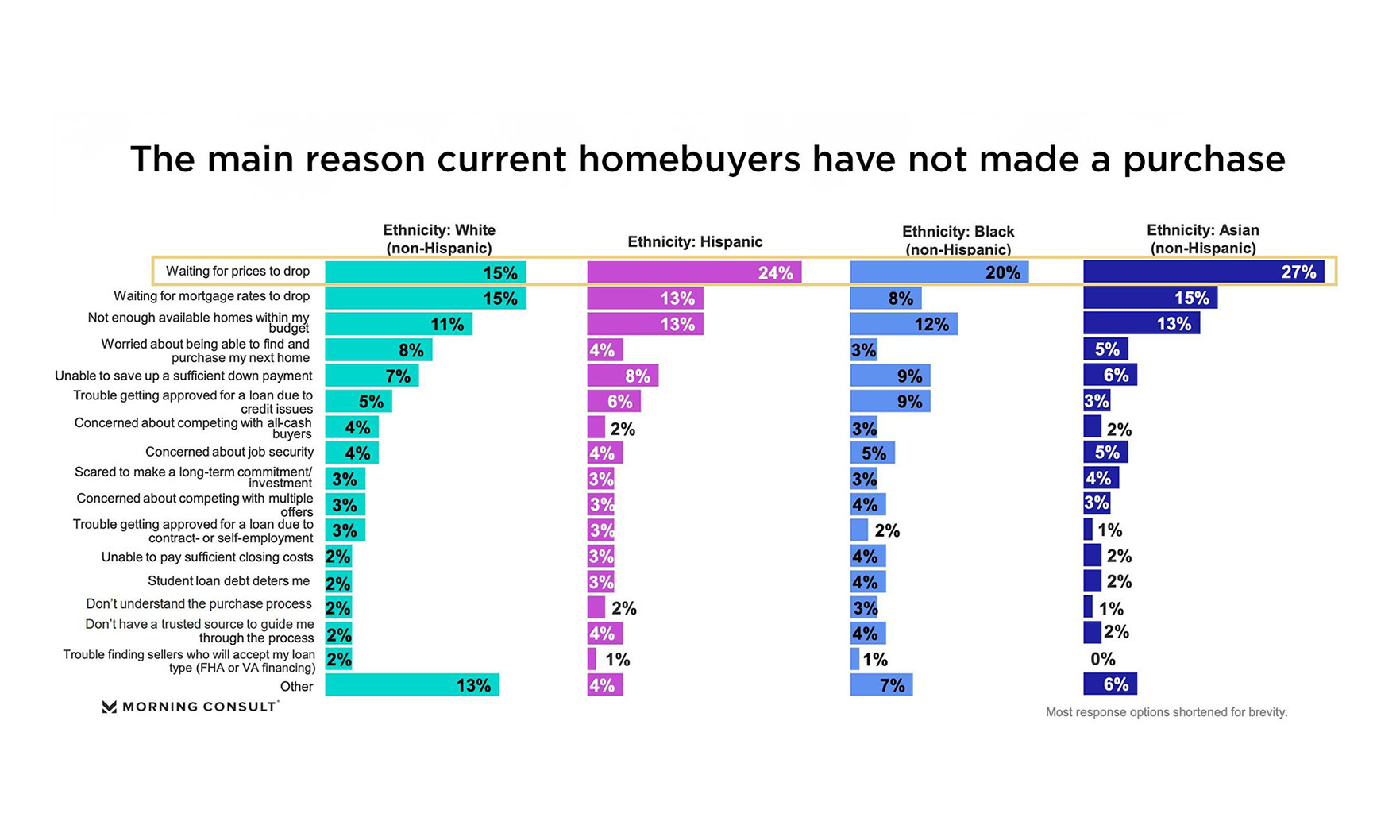

According to NAR’s 2023 Experiences and Barriers of Prospective Home Buyers Across Races/Ethnicities report, 27% of Asian homebuyers, 24% of Hispanic homebuyers and 20% of Black homebuyers said the No. 1 reason they’re waiting to buy a home is to see if prices drop.

However, slightly fewer white homebuyers said they’re waiting for prices to drop — 15% — while an equal 15% said they’re waiting for mortgage rates to decline. Those tied for the No. 1 reason white homebuyers are waiting to buy.

Mortgage rates came in at No. 2 for Asian, Hispanic and Black homebuyers. And across all four demographics, the No. 3 holdout was the same: “Not enough available homes within my budget.”

Simultaneously, NAR published another report focused on the Realtor side of this wait-and-see approach, asking agents details about the last buyer they’ve worked with who has not yet purchased a home. This report, the 2023 Experiences & Barriers of Prospective Home Buyers: Member Study, roughly mirrors the data from the consumer study.

According to the member study, the top three reasons why Realtors say buyers have not yet made a purchase are:

1. Not enough homes available in buyers’ budgets (34%)

2. Buyers are waiting for mortgage rates to drop (18%)

3. Buyers are waiting for prices to drop (9%)

Naturally, all three factors influence affordability, because limited inventory drives up prices and higher rates drive up monthly mortgage payments. Meanwhile, saving for a down payment is increasingly difficult. In the consumer study, 6% to 9% of all demographics told NAR that saving for a down payment is the main factor preventing their purchase. To be more specific, roughly half of all respondents cited current rent or mortgage payments and their current credit card balance/payments as the top reasons why.

“The impact is exacerbated among first-time buyers who are more likely to be from underrepresented segments of the population,” Jessica Lautz, deputy chief economist and vice president of research for the association, said in her analysis.

In the member survey, too, Realtors cite the same top causes hindering down payment savings, with the majority (53%) saying there is at least one issue holding back buyers. However, only 23% of Realtors say that affected buyers applied for down payment assistance programs. Though the most common reason is because their income is too high (30%), many Realtors say their clients did not know about the programs (19%) or that their clients are worried about remaining competitive in a multiple-bid situation (17%).

“Down payment assistance programs often fly under the radar for potential homebuyers,” Lautz said. Highlighting programs like FHA, VA or USDA loans, she encouraged agents to educate clients about these programs. “Doing so will bring in more first-time buyers and narrow the racial homeownership gap,” she added.