Slow but steady improvement in inventory, sales and affordability is the consensus outlook for residential real estate in 2026.

The downturn that’s gripped the U.S. housing market for years finally began to improve in 2025, giving much-needed leverage to many buyers who were sidelined by scarce supply, high demand and high prices. This “Great Housing Reset,” as Redfin’s predicting for 2026, has been a long time coming but is not guaranteed, thanks to a host of economic and policy risks.

“[A] substantial level of uncertainty continues to surround the housing market, making conditions in 2026 difficult to predict,” said Geoff Smith, executive director of DePaul University’s Institute for Housing Studies. “The trajectory of federal interest rate policy remains unclear, inflation and broader economic volatility continue to weigh on consumer confidence, and housing affordability challenges persist for a wide range of potential homebuyers.”

While home prices are expected to continue rising in 2026, the pace of their ascent is expected to be slower than wage growth, which will improve affordability, according to Redfin. At the same time, much-needed existing home inventory will continue coming online as more homeowners accept the current interest rate environment of 30-year, fixed-rate mortgages in the low-6% range. All of this will bring about increased home sales, which will continue to rise gradually from 2024’s 29-year nadir, according to Realtor.com.

A national consensus — for the most part

Among the major real estate platforms, most outlooks for home sales are within a narrow band of modest year-over-year growth, except for one outlier. Whereas Realtor.com has the lowest projected sales increase, at 1.7%, followed by Redfin, at 3%, and Zillow, at 4.6%, National Association of REALTORS® Chief Economist Lawrence Yun is predicting a hefty 14% surge.

“Next year is really the year that we will see a measurable increase in sales,” Yun said.

While Yun’s 2026 sales forecast stands apart from the general consensus, his prediction for sales-price growth is more in line with other estimates. Nevertheless, it’s still relatively bullish at 4%, compared to Realtor.com (2.2%), Zillow (2%) and Redfin (1%).

Interest rate projections all point to a 30-year mortgage rate of 6% to 6.3% following the three cuts of fall/winter 2025. Zillow predicts the average mortgage rate will be “above 6%” in 2026, while NAR predicts it to be “around 6%,” and Redfin and Realtor.com both expect an average rate of 6.3%.

“As interest rates gradually come down, buyer confidence should increase, which will help move demand that’s been building as buyers and sellers have stayed put,” Laki Hatzelis, broker-owner of RE/MAX 10, said. “In the southwest suburbs of Chicago, we’re already seeing price softening on outdated homes, and lower rates will give buyers more room to invest in renovations — helping that inventory move.”

Homebuilder confidence

On the producer side, the outlook is guardedly optimistic, as well.

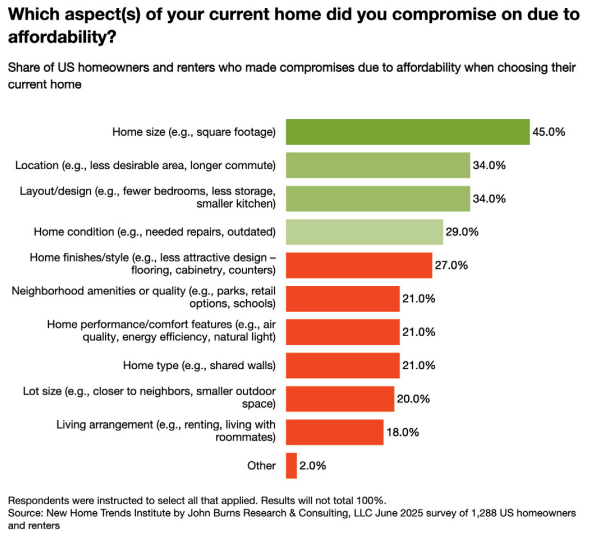

According to the Urban Land Institute’s 2026 Emerging Trends in Real Estate report, as for homebuyers, builders’ most significant headwind is affordability. One of the main ways they’re addressing this is by building smaller, lower-spec homes. Thus far, most buyers are willing to sacrifice home size and finish quality in exchange for price relief, according to the report.

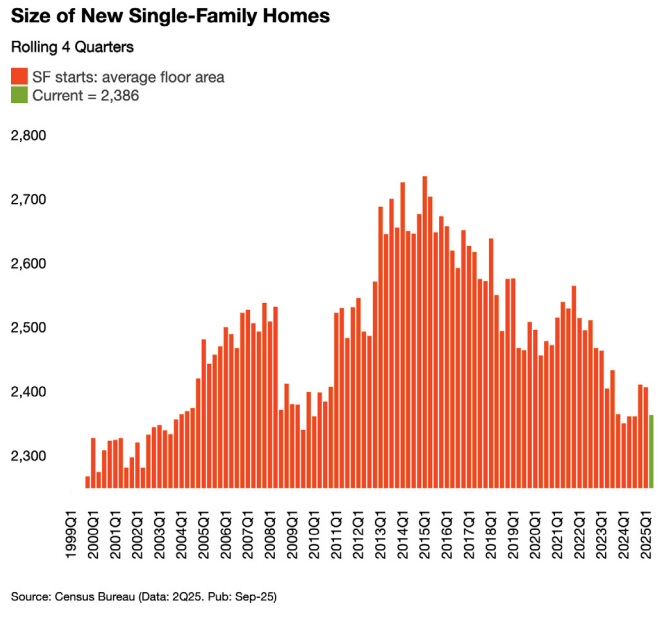

Accordingly, more than 60% of current home shoppers said they’d opt for a smaller home to buy a new one, ULI said, citing a survey by John Burns Research and Consulting. The average size of a new single-family home fell to 2,386 square feet in the second quarter of 2025 from a high of 2,692 square feet in 2016.

Some builders are lowering the spec level of homes to cut costs, ULI said, noting one builder is lowering ceiling height and providing fewer windows and lower-finish countertops to save on costs — with little pushback from affordability-minded buyers.

If the Great Housing Reset pans out as expected, real estate agents will still have to contend with a lingering disconnect between buyers — who recognize that in most cases, they are in the driver’s seat — and sellers — who still believe we’re in the post-COVID seller’s market.

“The biggest challenge will still be aligning expectations,” Hatzelis said. “Some sellers are holding onto peak-market pricing, while buyers are becoming more realistic about the work many homes require. As those expectations continue to normalize, we’ll see a healthier, more balanced market.”