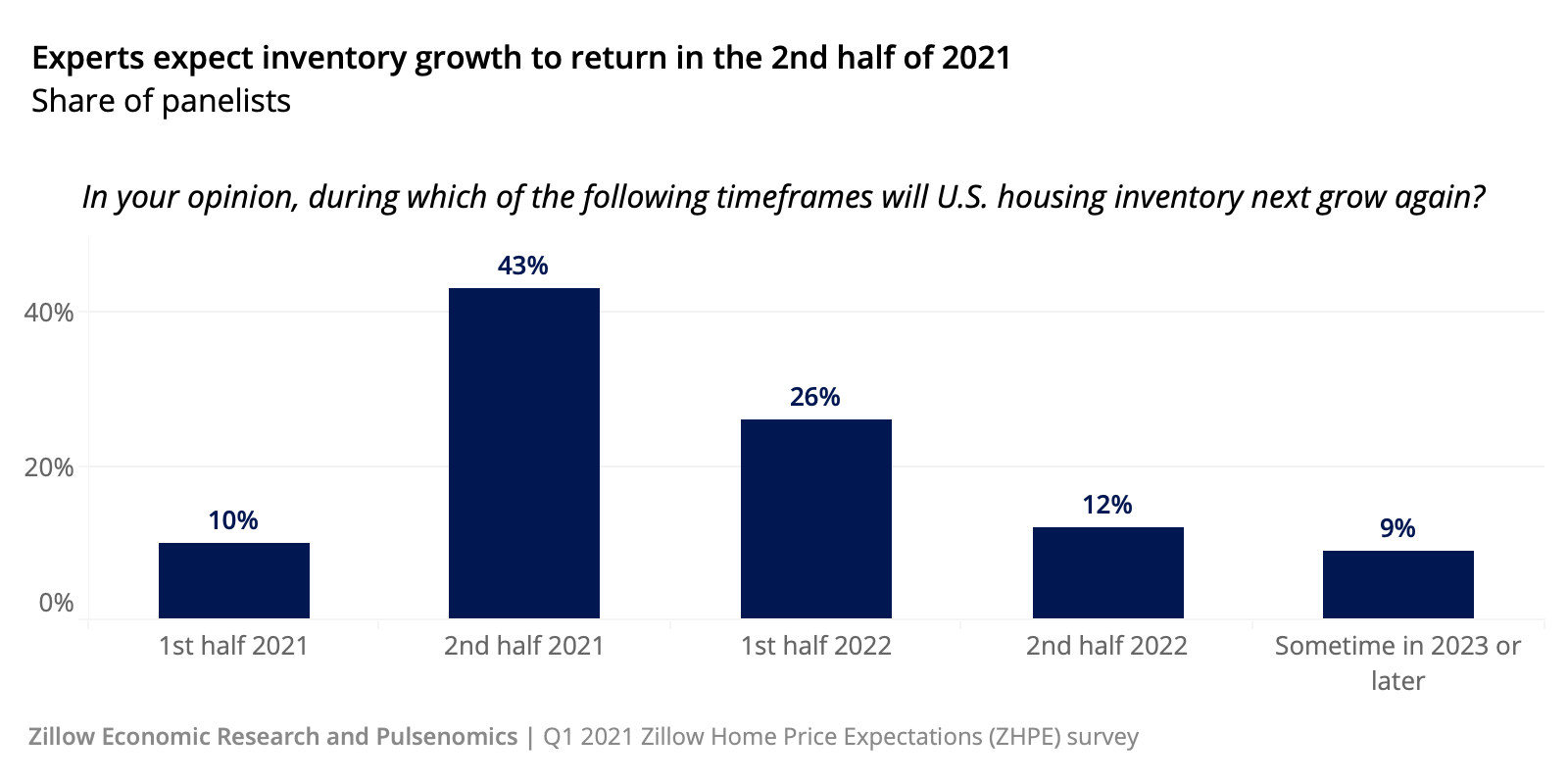

A plurality of economists and real estate experts surveyed by Zillow expects the second half of 2021 to deliver relief to the seemingly endless drought of housing inventory that has bedeviled U.S. markets during the pandemic.

Forty-three percent of respondents to the first-quarter Zillow Home Price Expectations survey expect inventory to improve in the second half of the year, followed by 26% who expect it in the first half of 2022.

Homeowners, many of whom have stayed put during the pandemic, finally listing their properties, are expected to be the main driver of the inventory increase, with 38% of survey respondents citing existing housing as the most likely catalyst for supply growth.

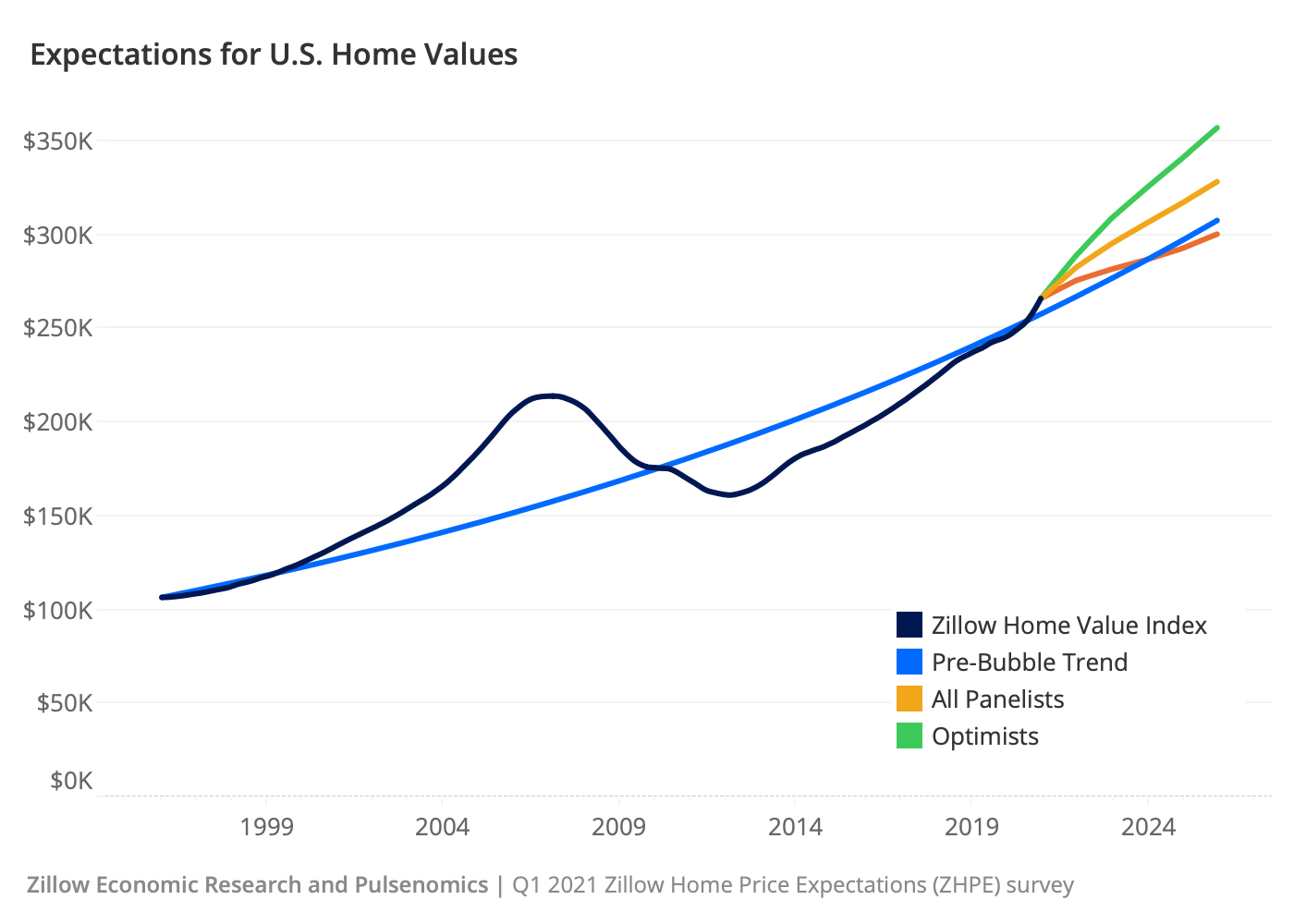

As supply increases, the fast pace of home-price growth is expected to slow from 6.2% in 2021 to 4.5% in 2022, 3.7% in 2023, 3.5% in 2024 and 3.6% in 2025.

“This is the most bullish near-term outlook for home prices we’ve seen from our experts since the early stages of the post-bust recovery, and the panel’s five-year average annual home price forecast has never been more optimistic,” said Pulsenomics founder Terry Loebs said in a press release, adding that “even with a robust economic rebound in the coming months affordability will likely remain a challenge for many aspirational renters looking to move into homeownership this year.”

The survey found other notable pandemic-related expectations as well.

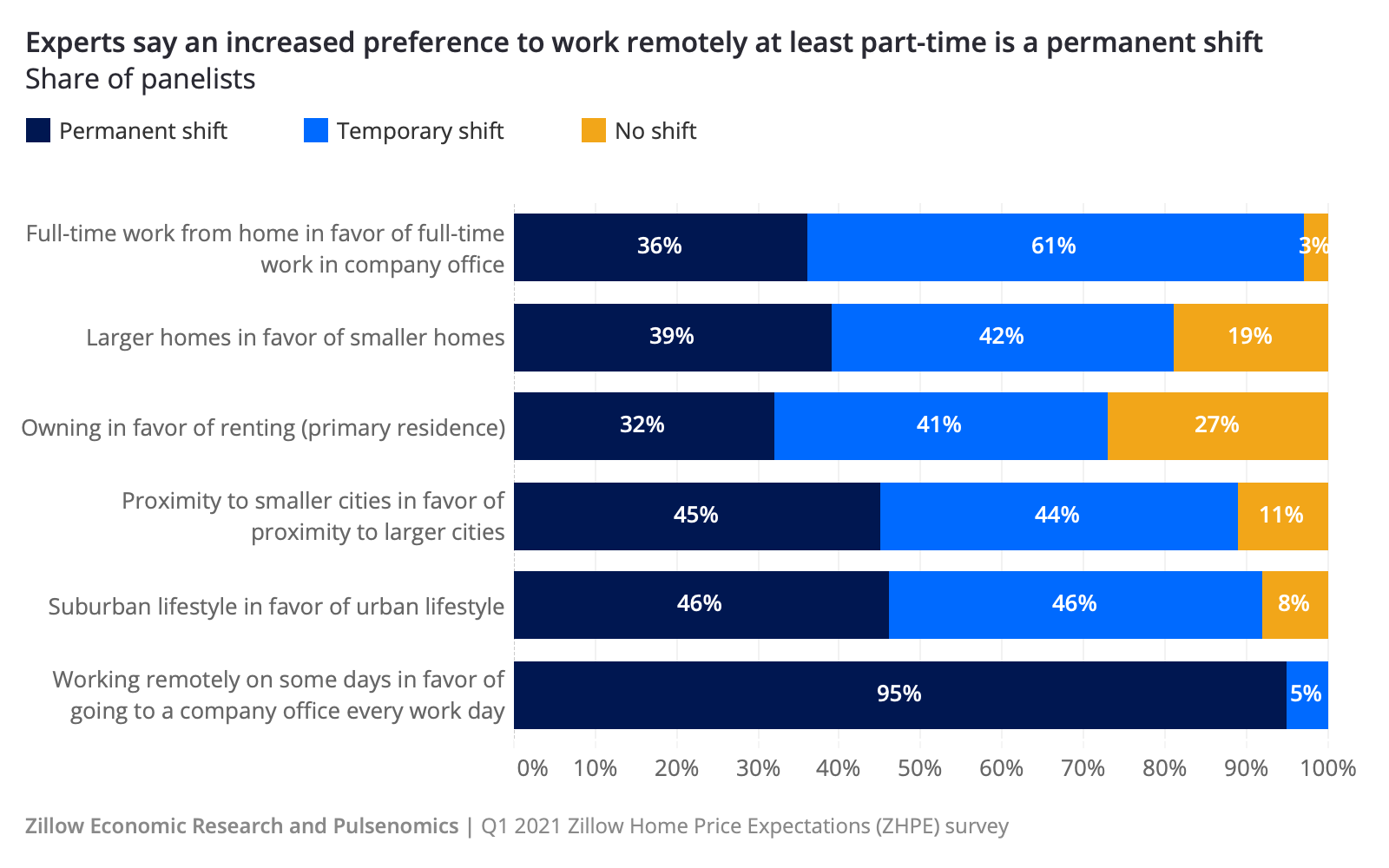

Of the 110 experts surveyed between Feb. 15 and March 1, 95% expect remote working is here to stay, at least part of the time.

The shift to a suburban life from an urban one is expected to be permanent by 46% of respondents, while an equal percentage expects the movement to be temporary. The shift to smaller cities from larger ones is similarly split, with 45% believing it to be permanent and 44% believing it temporary.