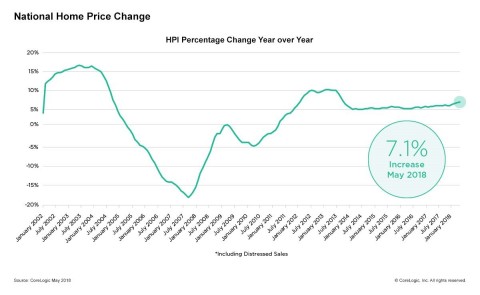

Home prices saw its highest jump in years and show no signs of slowing down, according to the Home Price Index and HPI Forecast for May 2018 from CoreLogic.

CoreLogic reported a 7.1 percent year-over-year rise in home prices from May 2017 to May 2018. On a month-over-month basis, there was a 1.1 percent increase from April to May.

As far as what’s to come, the CoreLogic HPI Forecast predicts home prices will rise 5.1 percent by May 2019 and 0.3 percent in June 2018.

CoreLogic also looked at the 100 largest metropolitan areas around the U.S. and their housing stocks. Using the housing prices and the long-run, sustainable levels of housing prices, the results categorized housing markets as undervalued, at value, or overvalued. In undervalued markets, housing prices are at least 10 percent below the sustainable level, while prices are at least 10 percent higher for overvalued markets.

TheCoreLogic found that 40 percent of metro areas had an overvalued housing market in May 2018. In the same month, 24 percent of housing prices were at value and 26 percent were undervalued.

When analyzing the top 50 markets and their housing stocks, CoreLogic found that 34 percent were at value, 14 percent were undervalued and 52 percent were overvalued.

In another related study, CoreLogic worked with RTi Research and found, despite the rising prices, homeowners and renters still plan on buying homes. CoreLogic found that 15 percent of homeowners and 28 percent of renters around the nation have a desire to purchase a home within the next year. According to the same study, only 11 percent want to sell.

“The CoreLogic consumer research demonstrates that, despite high home prices, renters want to get out of their rental property and purchase a home,” said Frank Martell, president and CEO of CoreLogic. “Even in the most expensive markets, we found four times as many renters looking to buy than homeowners willing to sell. Until more supply becomes available, we will continue to see soaring prices in cities such as Denver, San Francisco and Seattle.”