The white-hot pace of the housing market appears to be cooling to red, according to Redfin, which released a new report that includes several indications that the lopsided seller’s market could be inching closer to an equilibrium.

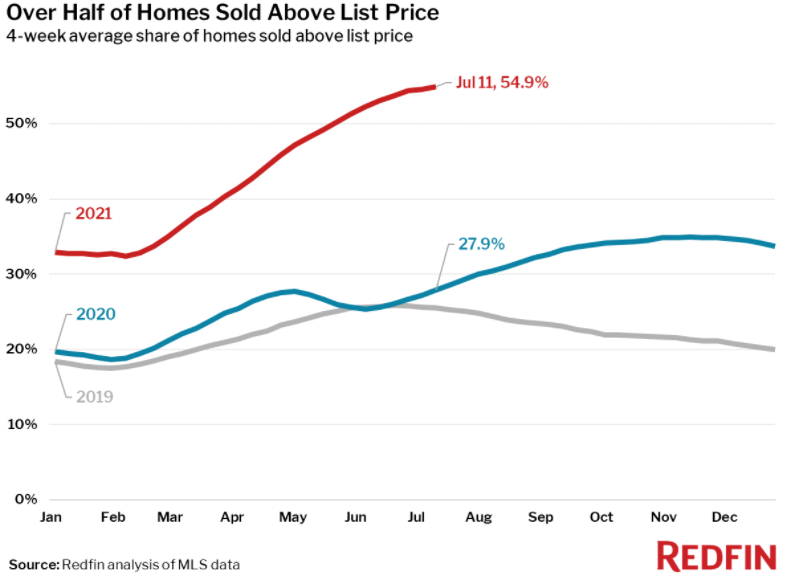

During the four-week period ended July 11, the average weekly share of homes for sale with a price drop surpassed 4% for the first time since September 2020, and the share of homes sold over list price, the share of homes sold within a week and the median days a home spent on market either cooled off or plateaued during the period, Redfin said in a release.

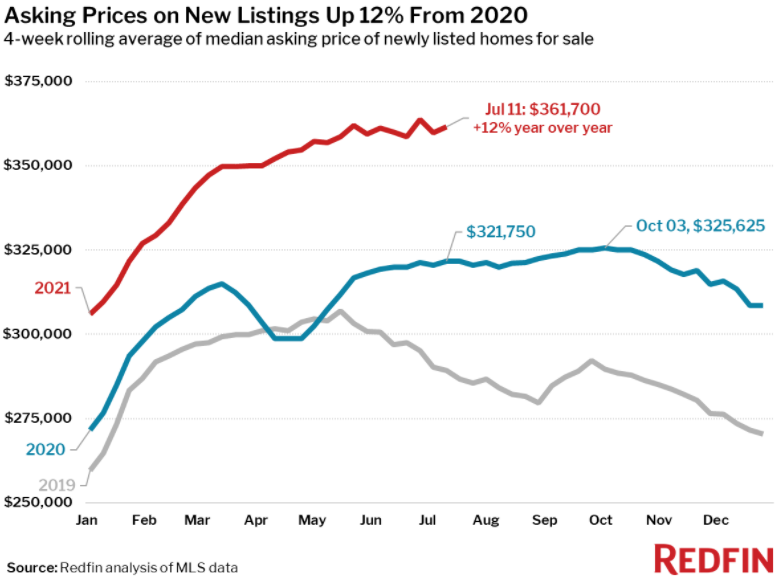

“Asking prices are still high, but the share of listings with price drops is rising steadily and could soon reach pre-pandemic levels,” Redfin chief economist Daryl Fairweather said in a release. “That’s an early indication that we are past the peak for this intense seller’s market. Buyers may begin to regain some negotiating power on properties that have been on the market for more than a week.”

Nevertheless, the median home-sale price reached a record high during the period, at $365,500, according to Redfin.

Nevertheless, the median home-sale price reached a record high during the period, at $365,500, according to Redfin.

Pending home sales had their smallest year-over-year increase in more than a year during the four-week period ended July 11, rising 11%.

A record 55% of homes sold above list price, which is up from 28% a year earlier, Redfin said. However, this measure appears to be plateauing, as it has been at 54% to 55% since the four-week period ended June 27, Redfin said.

The share of homes for sale with price drops rose to 4.1%, which is above the 2020 level and closer to the 2019 level of 4.7% at the same time in 2019.

The share of homes for sale with price drops rose to 4.1%, which is above the 2020 level and closer to the 2019 level of 4.7% at the same time in 2019.

Once market continues to level, a better chance for deserving owner occupants.