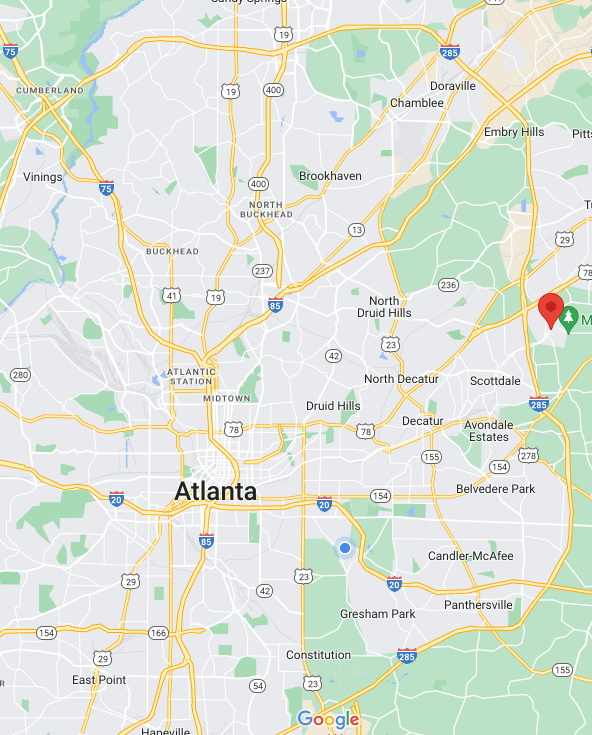

A Washington, D.C., mixed-use property developer and investor entered the Atlanta market with the acquisition of two affordable-housing apartment complexes in Clarkston, a move it says is “just the start” of its planned expansion in the Southeast.

The real estate firm, Jair Lynch Real Estate Partners, purchased the assets, Clarkston Station and Woodside Village, with Nuveen Real Estate, a global real estate manager with $152 billion of assets under management. In a release, the partners said the acquisition will help them advance “their shared goals of uplifting and revitalizing communities through their investment in high-quality, sustainable neighborhood assets.”

“With an incredibly diverse economy, a growing population, and job growth that continues to outpace the national average, Atlanta’s demand for high-quality, affordable housing will continue to rise,” Jair Lynch director of acquisitions Ulysses Auger said in a news release. “As an investor dedicated to preserving and increasing housing for working families and individuals, we look forward to meeting this important need and to making a positive impact throughout the region.”

Clarkston Station, a 356-unit community, and Woodside Village, a 360-unit community, both operate under the Section 42 Low-Income Housing Tax Credit program with affordability restrictions through 2034 and 2036, respectively. A collective 95% of the units will continue to serve residents earning up to 60% area median income for at least the next 12 to 14 years, the companies said.

Jair Lynch said its housing strategy seeks to increase and preserve affordable housing for people earning between 30% and 120% of area median income. While the firm did not provide financial details of the transaction, it said the purchase of the properties means it has now invested over $1.3 billion toward this initiative.

“Clarkston Station and Woodside Village are home to a large community of hardworking individuals and families, including essential workers, first responders, educators and more, who deserve quality, attainable housing options,” Nuveen senior director of impact investing Mike Gilmartin said. “We’re proud to support resident well-being through sustainable improvements and robust resident services, and we look forward to executing the business plan with Jair Lynch.”

The partners brought on Cushman & Wakefield as the new property manager with a specific focus on resident services and community programming. The new owners will perform deferred maintenance and make capital improvements, including in-unit updates and upgrades to community amenities, like clubhouses, playground equipment, grill stations, dog parks and sustainable landscaping. They also plan to improve safety and security with new lighting, gated front entrances, security cameras and patrol services.

Berkadia’s Paul Vetter served as the seller’s broker, while Nixon Peabody served as Jair Lynch and Nuveen’s transaction counsel. CBRE provided financing.