A new study from the Federal Reserve brings more evidence to the table on the damaging economic effects of high student debt burdens

Creative Commons 2.0: Justin Wong, http://commons.wikimedia.org/wiki/File:University_of_Chicago_Bartlett.jpg

We’re written in the past about the effects of student loan debt on the housing market – in 2014, for instance, it’s estimated that student debt cost the market more than 400,000 home sales – but a new report from the Federal Reserve has perhaps offered the clearest sign yet of how student debt negatively impacts housing.

In short, we now have math on our side. Using a series of computations, the Fed found that for every $10,000 increase in student debt per graduate, the share of 25-year-olds living with their parents rises by 2.9 percent, as Millennials opt to stay home and save money.

Millennials Living at Home – a Stunning Rise

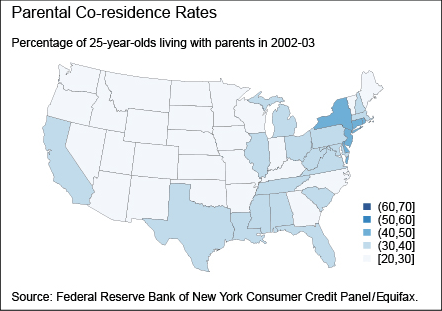

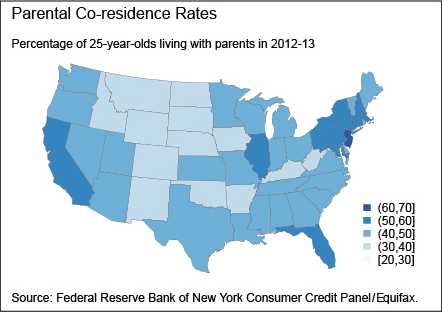

Extending its analysis to 48 states, the Fed uncovered a stunning statistic: in 2003, there were 25 states where 20 to 30 percent of 25-year-olds lived with their parents; by 2013, though, all 48 states had such rates of Millennials living at home, and for 12 stats, the “parental co-residence rate,” as the Fed calls it, had exceeded 50 percent.

Here are two amazing charts from the Fed that show the trend:

The Kids are (Not) Alright

So, where does this leave us? In short, it means that the long-term trends for housing still have considerable weeds to wade through, pending any unforeseen economic juggernauts that benefit Millennials. And as The Wall Street Journal highlighted in a recent article, the Fed’s study sits comfortably next to similar research on student debt. According to a study by Edvisors, a college graduate in 2014 completed college with an average student debt burden of $33,000, which is double of what it was in 1993.

Finally, 25-year-olds are hardly the only ones living at home and buying fewer homes; as our graph below demonstrates (recreated from Fed data), 30-year-olds are stuck in the same rut, as double-digit home price increases have pushed many housing markets out of reach for Millennials: