Current Market Data

At the same time, mortgage applications declined 1.7% on a seasonally adjusted basis on a week-over-week basis, according to the Mortgage Bankers Association.

In Atlanta, home prices posted a 20.1% year-over-year gain in August, compared to a 22.8% gain in July. Month over month, prices fell 0.4%.

Atlanta’s home values have also risen well above affordability norms.

“After a sustained period of quick sales that kept the housing cupboard relatively bare, a supply of two months presents a lot more options for homebuyers,” said RE/MAX President and CEO Nick Bailey.

The only other time the market saw such change was at the beginning of the pandemic.

Month over month in September, existing-home sales slid 1.5% to 4.71 million, which is 23.8% lower than the year before.

New home construction missed analyst estimates in September, falling 8.1% month over month to an annual rate 1,439,000 homes, according to government statistics.

The report shows decreases in sales prices, as well as an overall increase in days on the market. While this could be due partially to high interest rates, Bailey says the shift in the market could open up opportunities for buyers who’ve had to put their plans on hold.

Approximately 58% of homebuyers say they’d be willing to purchase a haunted house — and nearly 25% think they already have.

The number of homes sold in September fell 9.8% from August to 5,680 properties, which was 21.9% lower than the 7,274 homes sold a year earlier.

The analysis found an increase in mortgage denials and in potential borrowers withdrawing mortgage applications in areas with an elevated risk of flooding.

Looking ahead, CoreLogic expects the year-over-year pace of home-price appreciation to slow to 3.5% by August 2023.

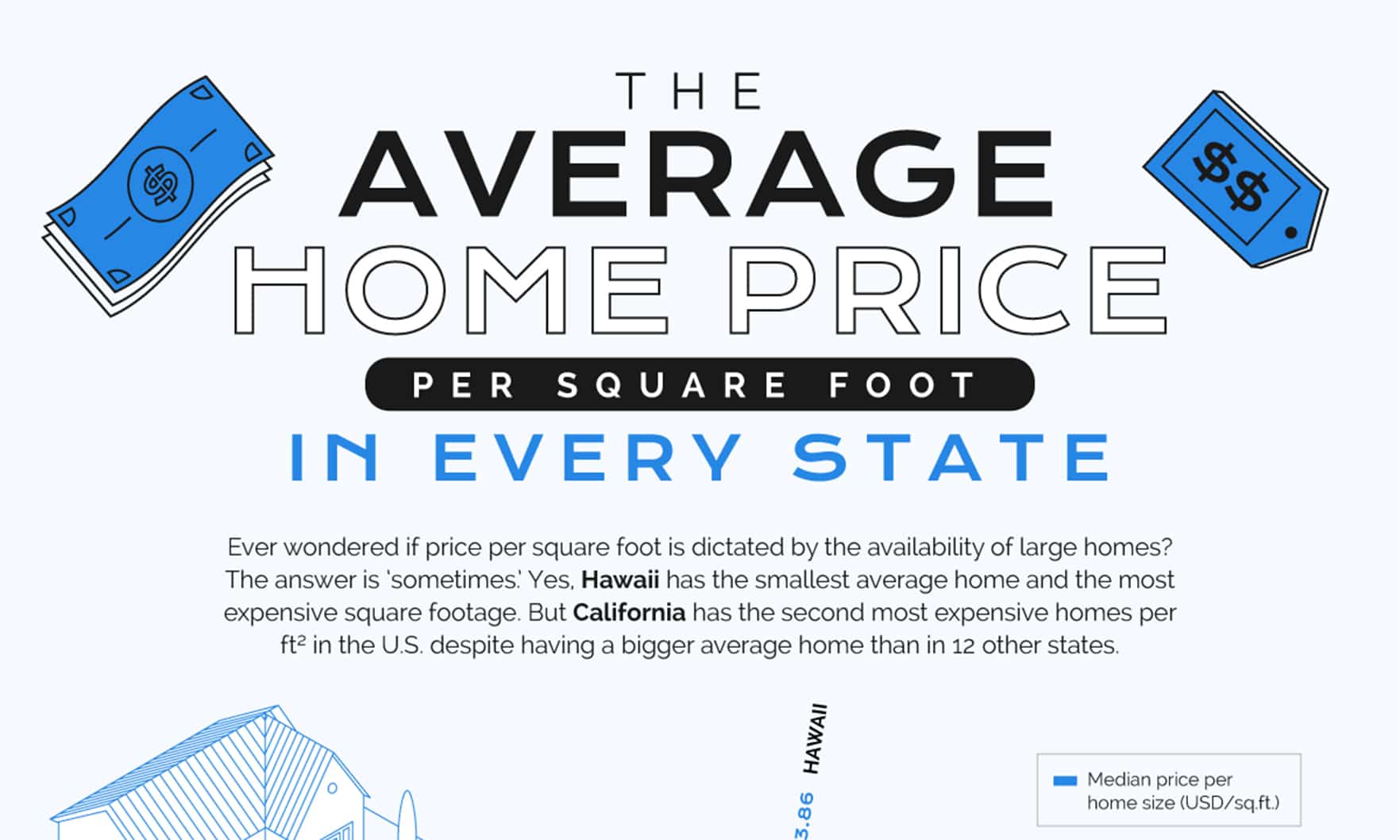

The average median home size varies drastically across the country, according to American Home Shield’s 2022 American Home Size Index.

Market volatility is causing more and more homebuyers to delay or cancel plans to make a purchase.

Rising mortgage rates have led to a substantial increase in the number of markets considered overvalued.

Mortgage rates continue to fluctuate by nearly half a percentage point every month, leaving homebuyers facing the most volatile three-month period they’ve seen since 1987.