Current Market Data

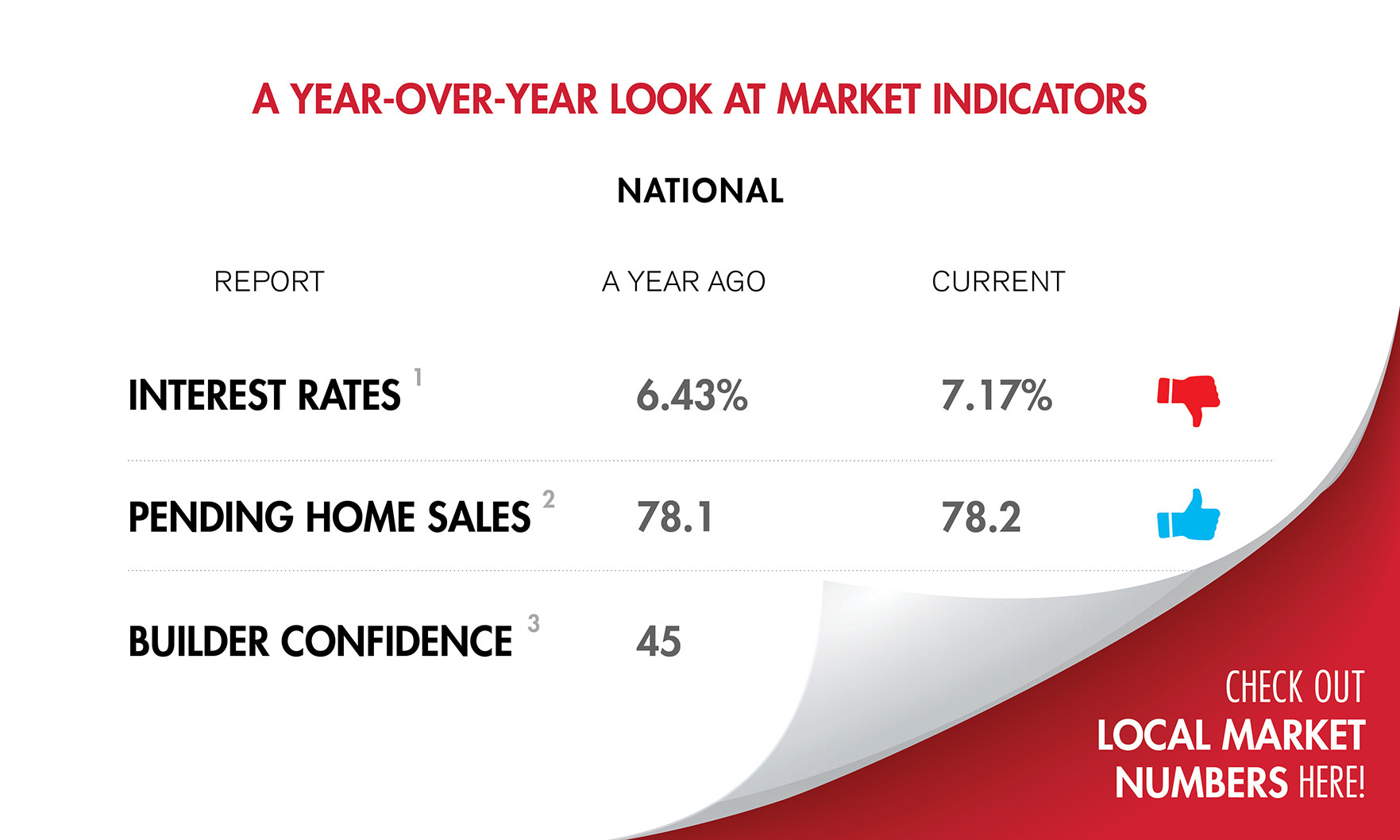

The pace of home sales continued to gain steam, as home prices gained ground as well, according to the latest Housing Market Snapshot from Georgia MLS.

At the same time, home sales declined as days on market ticked higher.

Architecture Lab ranked every U.S. state based on the difference between average home values in 2013 and 2023; Georgia ranked No. 4.

Monthly home payments hit new records last month reaching an all-time high of $2,747, an 11% increase from last year.

A relatively low cost of living and a vibrant entertainment scene placed Atlanta high on a new ranking from Apartment Advisor.

At the same time, the pace of home sales surged on a monthly as well as a yearly basis.

In 2020, median renovation spending was $15,000. That amount increased by 60% in three years, with the median home renovation costing $24,000 in 2023.

Prospective sellers should prepare to jump on the market — the week of April 14 through 20 will be the best time to sell this year.

Sales rose 9.5% from January to a seasonally adjusted annual rate of 4.38 million.

There’s a reason many homeowners opt for neutral shades when trying to sell their house — certain flashy colors may be off-putting to buyers.

Many buyers entered the housing market for the first time in 2023. But who were these first-timers, and what did their homebuying experience look like?

With the spring market right around the corner, the U.S. housing supply finally got a boost.

Location, location, location … at least that’s how the old real estate adage goes, right?

A variety of metrics in the Georgia MLS 12-county Housing Market Snapshot showed the beginnings of a robust spring selling season.

The median existing-home price for all housing types was $379,100, up 5.1% from $360,800 a year before.

Home might really be where the heart is. According to a new Zillow survey, 42% of recent homebuyers reported finding love after buying their new home.