Austin-based property technology company homebldr is launching a new service that claims to “revolutionize” the relationship between investors and real estate agents.

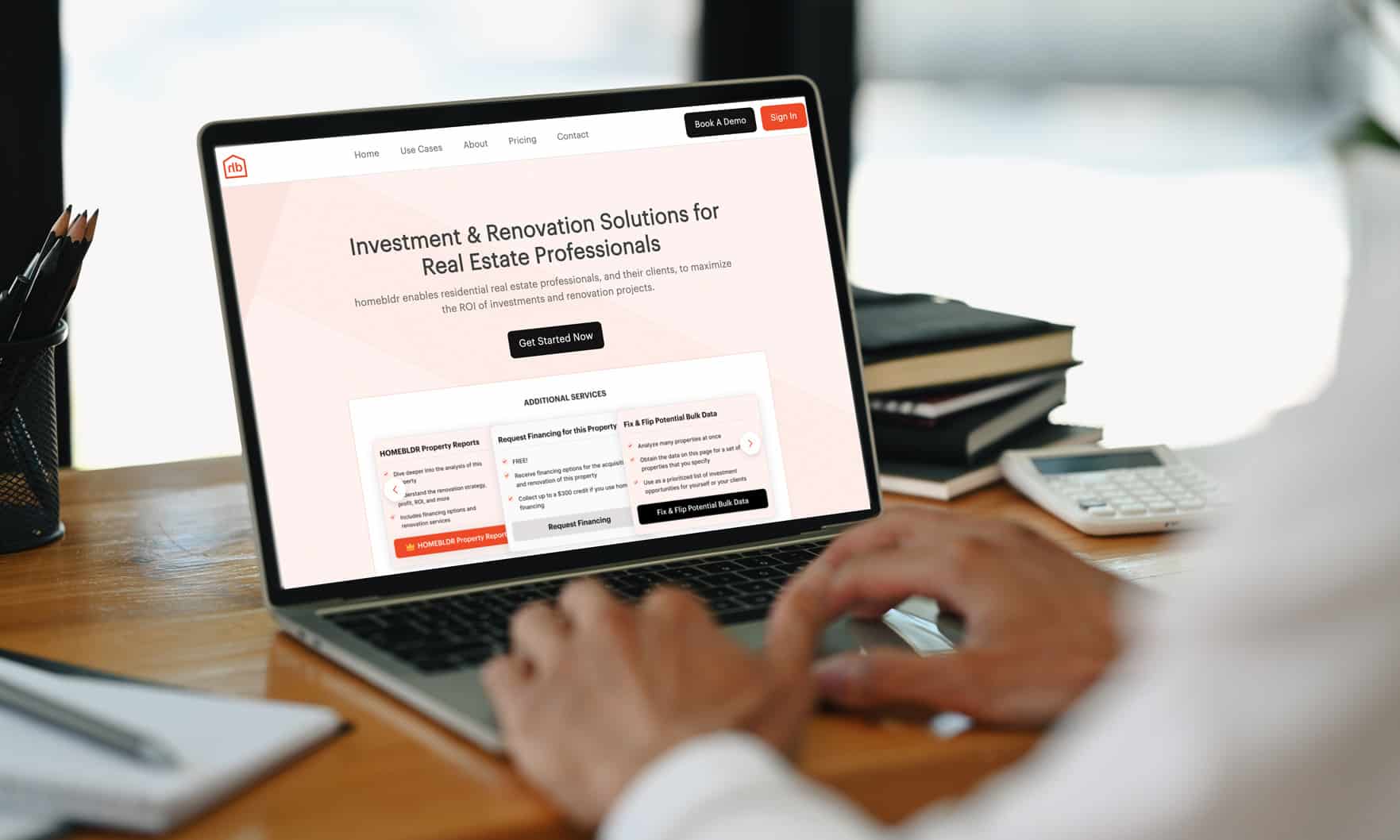

The portal, homebldr.ai, which is powered by artificial intelligence, was designed to connect real estate investors and agents by consolidating key aspects of the real estate investment experience in one place.

Despite a surge in real estate investment activity over the past several years, the average return on investment has plummeted. homebldr cites a March 2023 report from ATTOM that found the average gross ROI on fix-and-flip investments fell from 46% to 28% over the course of a year. homebldr.ai aims to combat this by identifying high-quality investment opportunities for users.

According to homebldr, key features of the product include property and investment analysis, location analytics and property characteristics. The product is also fully integrated into homebldr’s Solution Suite. But what does the product do?

“homebldr.ai helps agents generate more transactions with investor clients in significantly less time by evaluating investment opportunities in seconds and providing the deal analysis, competitive financing options, and construction services necessary to maximize returns,” CEO Adam Eldibany explained.

Specific components of homebldr.ai include after-repair value analysis, value-add potential analysis and specialized HOMEBLDR Property Reports. The portal also contains info similar to standard multiple listing services, like listing status and property details.

“Historically, investors have been a difficult client case for real estate professionals due to their frequent requests for deal analysis, desire to work with multiple agents at the same time and prolonged hesitation to get into details regardless of how much work their agent has put in,” Eldibany said. “However, the benefit of being patient and continuing to work with investors is that they typically transact multiple times per year, while owner-occupant clients move once every seven years.

“Shifting focus to the present, 90% of owner-occupant homeowners are locked into their sub-6% mortgage rates, which has caused home sales to hit the lowest level in over a decade. Meanwhile, investor transactions remain near the all-time high level achieved in 2022,” he added. “This presents a massive opportunity for real estate professionals to generate more transactions by serving the growing community of investors.”

Free trials for homebldr.ai began Aug. 1.