Real estate firm leaders are worried about housing affordability and inventory in the next two years, according to the 2023 Profile of Real Estate Firms by the National Association of REALTORS®.

The report offers a profile of the “typical” real estate firm by surveying NAR’s brokers of record — more than 200,000 in NAR’s membership — and offers insights into what those brokers see on the real estate industry’s horizon. The report covered both commercial and residential operations, but 80% of respondents work in residential firms.

Affordability and inventory topped the list of concerns, along with the challenge of keeping up with technology, the report said.

“With interest rates rising to more than 20-year highs, it is no surprise that the biggest current concern for real estate firms is housing affordability,” said Jessica Lautz, NAR deputy chief economist and vice president of research. “This surpassed the concern of maintaining sufficient inventory, which we saw in 2021.”

The ‘typical’ firm

The most-common firm in the survey was an independent, non-franchised operation with three full-time real estate licensees in one office. Thirty-eight percent of firms surveyed covered a metropolitan region market area, 26 percent covered a rural area or small town, and 18 percent covered multiple metro areas or regions.

The typical one-office residential firm had been operating for 16 years and did a median of 15 transaction sides and a median sales volume of $5.3 million in 2022.

The firms with more offices, not surprisingly, did more volume. But the increase was exponential. Firms with four or more offices had more than 400 transaction sides and a median brokerage sales volume of $154.6 million in 2022.

Nearly all the business, approximately 97%, done by firms was from returning clients or client referrals, according to the survey. Mailings, door-knocking and social media provided fewer direct results, according to those surveyed.

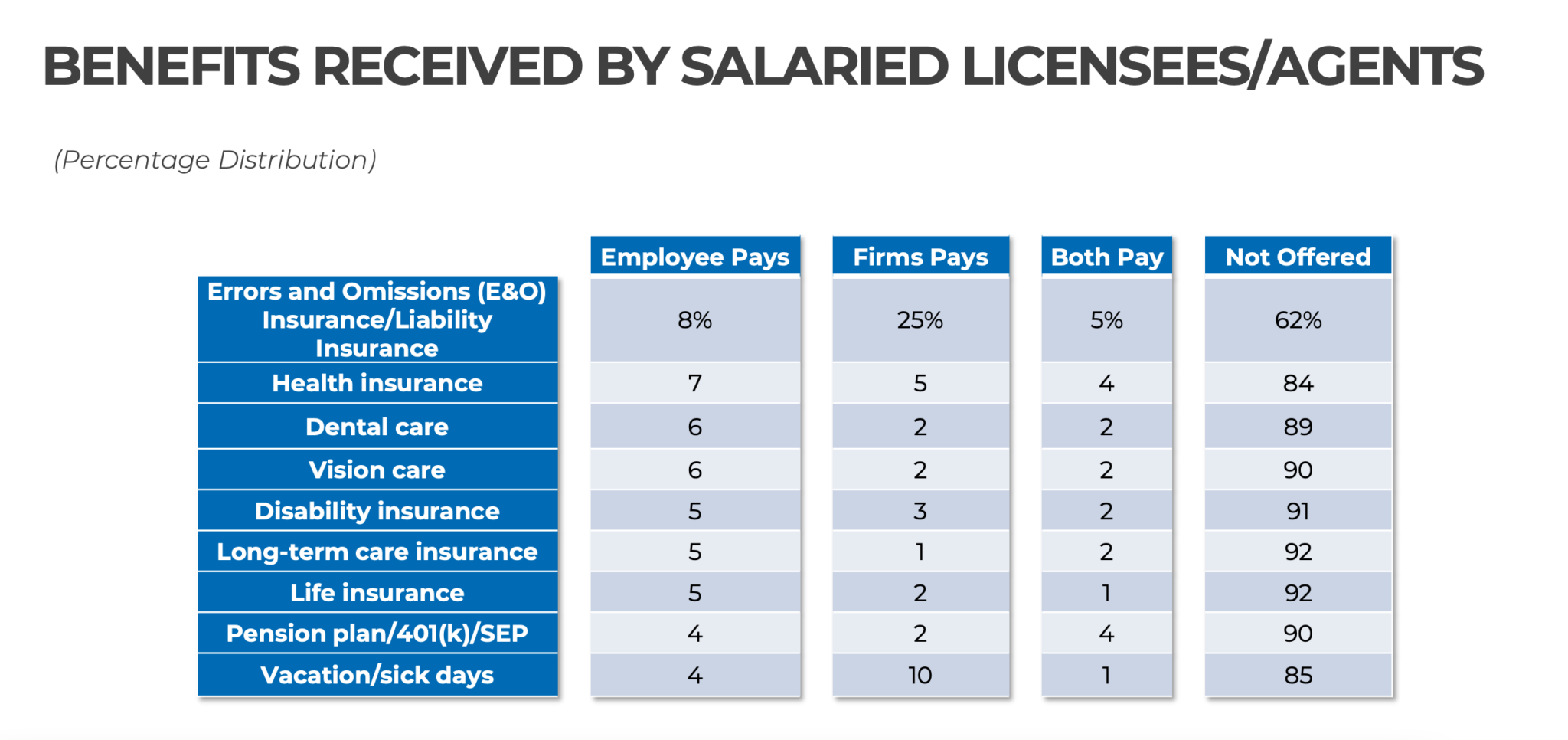

The most common benefit offered to agents by firms was errors and omissions/liability insurance. Thirty-eight percent of offices offered that. One-quarter of firms offered virtual office space for staff, while 8% offered a virtual assistant.

Market outlook

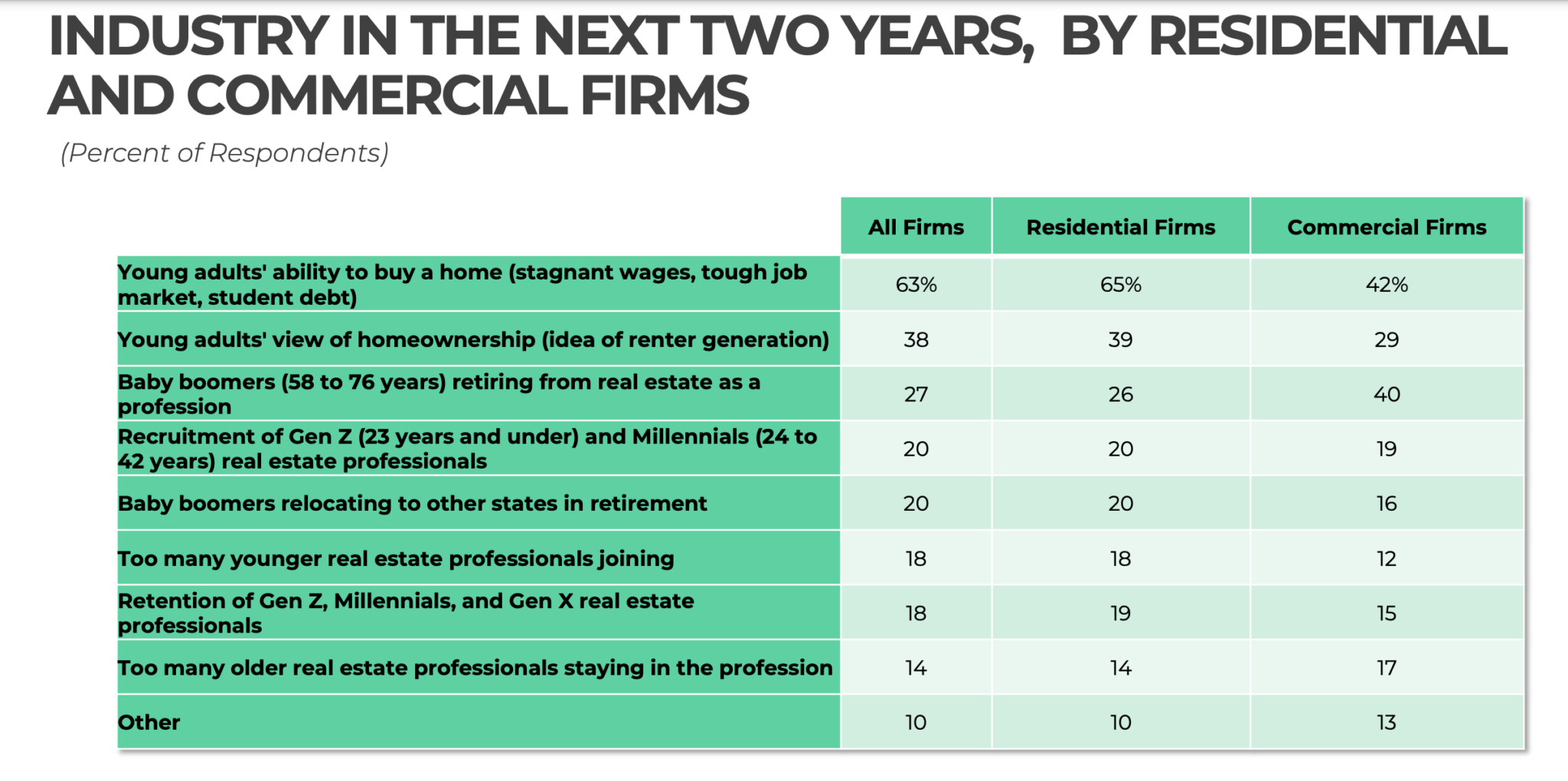

Affordability remains a chief problem cited by those surveyed. Sixty-three percent of firms expressed concerns about young adults’ ability to buy a home, 38% said they worry about young adults’ views of homeownership and 27% see Baby Boomers retiring from real estate as a primary concern.

“Housing affordability has had an impact on real estate firms’ overall sales activity,” Lautz said. “There are fewer buyers who can purchase a home due to the rise in prices and interest rates, and fewer sellers are motivated to make a move. While sales are down, sales volume has increased as home prices have augmented because of limited inventory.”

Thirty percent of firms expect their net income to increase this year, a decrease from two years ago when that percentage was nearly double.

“Due to tight inventory, the outlook among real estate firms is more conservative since the pandemic-induced housing boom,” Lautz said. “Only 30% of real estate firms believe there will be an increase in profitability from all real estate activities, compared to 58% two years ago.”.

While there are obvious concerns about the factors holding back the housing market, there was also some optimism in the NAR report. Forty percent of firms reported they were actively recruiting sales agents in 2023.