Fannie Mae released a report showing overall confidence increase in the housing market yet homebuyer confidence dips to an all time low, creating a split housing market.

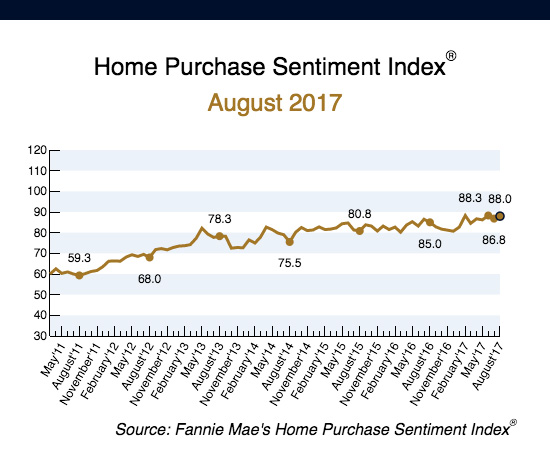

Fannie Mae’s 2017 Home Purchase Sentiment Index (HPSI) increased to 88.0 which is three percentage points up from last year. However, the extreme gap in homebuying and selling confidence found in HPSI shows the housing market becoming increasingly divergent.

The report found that while the number people who believe this year is a good time to sell increased by eight percentage points to 36 percent, conversely, the net share of people who find this year to be a poor time to buy fell by five percentage points to 18 percent. This is the second consecutive month that buyer confidence has reached an all time low. The percentage of people who found it a good time to buy versus people who believe it a bad time to buy reached new survey highs and lows respectively.

“In the early stages of the economic expansion, home selling sentiment trailed home buying sentiment by a significant margin. The reverse is true today,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “The net good time to sell share is now double the net good time to buy share, with record high percentages of consumers citing home prices as the primary reason for both perceptions. Such a sizable gap between selling and buying sentiment, if it persists, could weigh on the housing market through the rest of the year.”

Fannie Mae reported that the net share of Americans also felt that home prices will go up in the future increased to 48 percent. This prediction would follow the trend of increasing median downpayment percentage and could also be one reason Americans’ confidence in home buying is at an all time low. Another potential reason is that the survey found that overall confidence in American jobs has decreased by one percentage point to 74 percent.

Fannie Mae’s HPSI analyzes data collected from Fannie Mae’s National Housing Survey and produces all collected information about homebuying sentiment is then calculated into a single number. HPSI represents the current attitudes and future expectations for the housing market.