Several long-term trends, including the explosion of student debt, is making homeownership a distant goal for most millennials. In a new Apartment List report, a renter survey analyzing responses from over 11,000 millennials across the United States found that indebted college graduates are saving significantly less for a down payment compared to those without debt, while those without a college degree save even less.

The data found in the survey suggest that most millennial renters still have a long way to go before having enough saved to afford a down payment.

Since 1980, the median family income has grown 25 percent. Over the same period, the median home price grew at 2.4 times that rate, an increase of 60 percent. As college has gotten more expensive, the average cost of undergraduate tuition grew at 6.5 times as fast as the median income, increasing by 160 percent. When discussing the impact of these trends that are making it increasingly difficult for millennials to save for a home, it is important to consider historical context.

For decades, the cost of a college education has been skyrocketing, while incomes have grown much more modestly. From 2005 to 2015, a study last year by the Federal Reserve Bank of New York found that students graduating in 2015 with loans had an average student debt of $34,000, a 70 percent increase from 10 years earlier. The study notes that “having student loans dampens homeownership rates at every level of education, and higher debt balances are associated with even lower homeownership rates.”

Millennials without a college degree worse off than those with debt

Millennials represent the largest generation in our nation today, and their ability to purchase homes has broad implications for the housing market and society as a whole. The fact that students feel increasing pressure to attend college to compete in today’s economy, coupled with the growing cost of a college education, has important implications for the housing market.

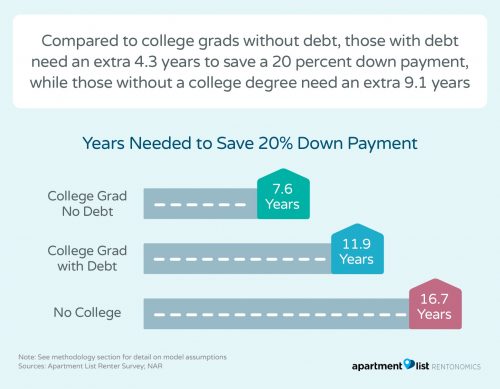

Data from the Apartment List Renter Survey shows that college graduates with debt are saving significantly less toward a down payment compared to those without debt. That said, those without a college degree are least prepared for homeownership.

The report divided respondents into three groups:

- those with a bachelor’s degree or higher and no student debt;

- those with a bachelor’s degree or higher with student debt; and

- those who did not graduate college, including respondents who attended “some college” but did not attain a bachelor’s degree.

Millennials in the three groups reported that they wanted to achieve homeownership at essentially the same rate, with 79 to 80 percent of each group stating that they planned to purchase a home in the future.

The average college graduate without student loans has $13,900 saved for a down payment, compared to $6,500 for college grads with debt and just $3,400 for those without a college degree. It would take an estimated 7.6 years for the average college grad without debt to save enough for 20 percent down payment on a condo, compared to 11.9 years for college grads with debt and 16.7 years for those without a college degree.

In other words, a 25-year-old who did not attend college would not have enough saved for a down payment until they are 42; assuming a 30-year mortgage, they would be paying off her home loan into their 70s.

For most American homeowners, their house is their largest financial asset, and homeownership has long been the key source of wealth creation for many American families. Large student debt burdens and a lack of high-paying job opportunities for those without college degrees will likely become a source of deepening wealth inequality in America as homeownership moves increasingly out of reach for those from less privileged backgrounds.

Millennials are facing a housing market with a historic shortage of starter home inventory, as well as the recent changes to the tax code that make homeownership less attractive. Furthermore, the best job opportunities are increasingly clustered in a handful of superstar cities, where real estate prices are far above the national average, making homeownership an even more distant dream.