By the Numbers

In Atlanta, home prices posted a 20.1% year-over-year gain in August, compared to a 22.8% gain in July. Month over month, prices fell 0.4%.

Month over month in September, existing-home sales slid 1.5% to 4.71 million, which is 23.8% lower than the year before.

New home construction missed analyst estimates in September, falling 8.1% month over month to an annual rate 1,439,000 homes, according to government statistics.

The number of homes sold in September fell 9.8% from August to 5,680 properties, which was 21.9% lower than the 7,274 homes sold a year earlier.

Looking ahead, CoreLogic expects the year-over-year pace of home-price appreciation to slow to 3.5% by August 2023.

The average median home size varies drastically across the country, according to American Home Shield’s 2022 American Home Size Index.

The National Association of REALTORS® expects existing-home sales to close 2022 15.2% lower compared to 2021, thanks to economic uncertainty and rising mortgage rates.

Sales of new homes in the U.S. jumped 28.8% between July and August, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

New listings of homes in the Atlanta area were down on a monthly and yearly basis.

The median existing-home price for all housing types in August was $389,500, a 7.7% rise from the year before.

New-home construction posted a 12.2% month-over-month increase in August, thanks in large part to a significant jump in multifamily building.

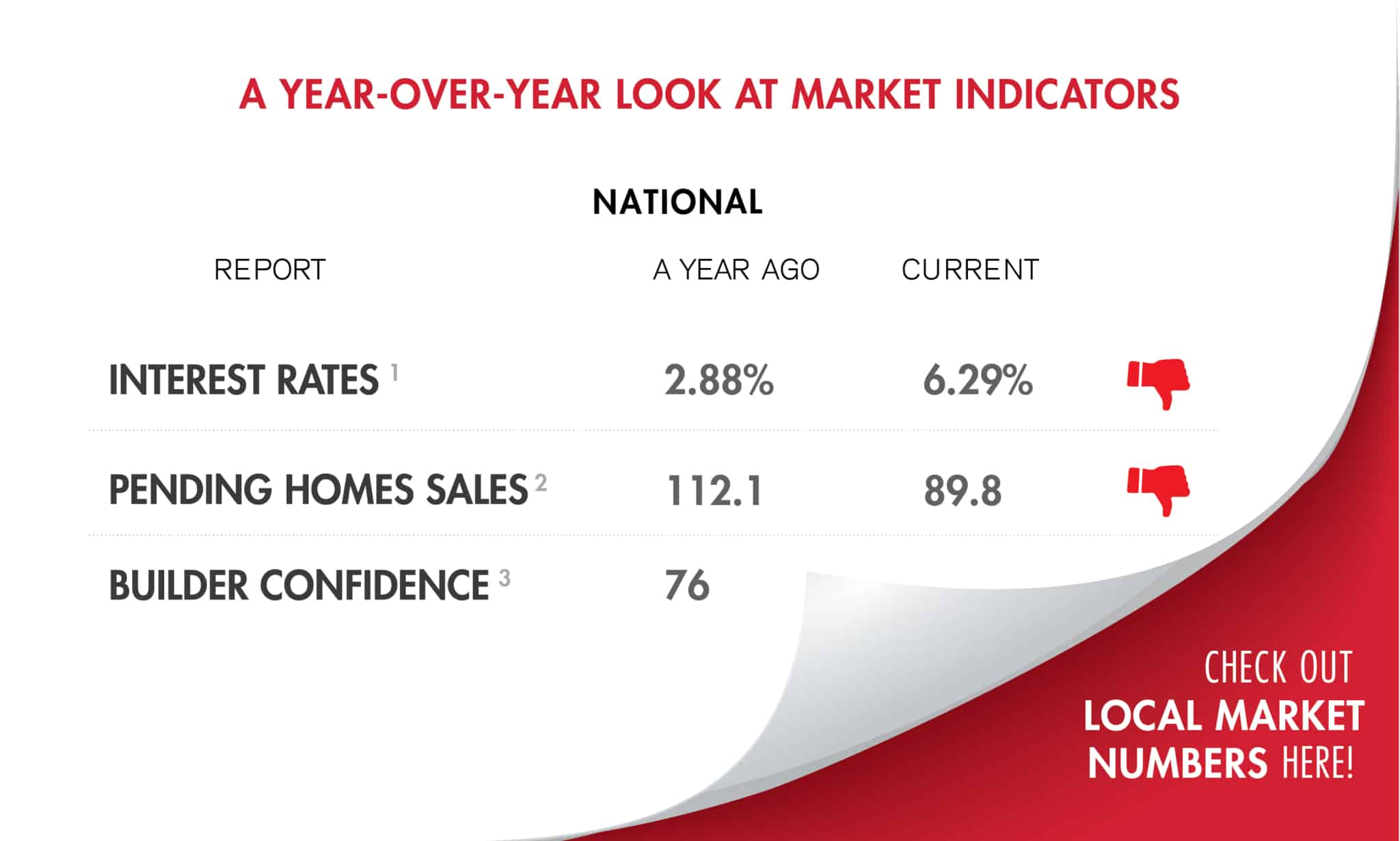

A continuing combination of increased interest rates, supply-chain disruptions and high home prices has sapped homebuilder sentiment every month this year.

Atlanta’s urban core saw more multifamily units delivered over the last 10 years than any city in the U.S., a StorageCafe study finds.

Mortgage applications declined 1.2% during the week ended Sept. 9, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

The median price first topped $400,000 in May, when it rose 3.6% from April to hit $409,400. It rose again in June to $411,375 before beginning its retreat last month.

Nationally, builder confidence posted a steep decline.