Current Market Data

Total existing-home sales rose to an annualized rate of 6 million in August, the highest level since December 2006, according to the National Association of Realtors.

A new report form First American Financial Corporation shows strong fundamentals like demographic demand and low interest rates are propelling housing market potential.

A new report from CoreLogic shows homeowners gained over $620 billion in equity in Q2 2020.

The latest New Residential Construction report points to builder momentum, though supply-side challenges linger.

Home sales across the nation were up 4.3% year over year, making it the third best month for home sales in the 13-year history of the report.

A new report from the Mortgage Bankers Association shows a slight drop in mortgage application volume amid expectations of further mortgage rate reductions.

A new report from the financial website Wallethub ranks each state on COVID-19 restrictions.

July rent price increases in lower-priced rentals far exceeded other price levels, according to a new report from CoreLogic.

The biggest players in the iBuyer market closed up shop at the beginning of the pandemic, and a new report shows the numbers.

The share of consumers who say now is a good time to buy a home has risen to 59%, according to the latest Fannie Mae Home Purchase Sentiment Index.

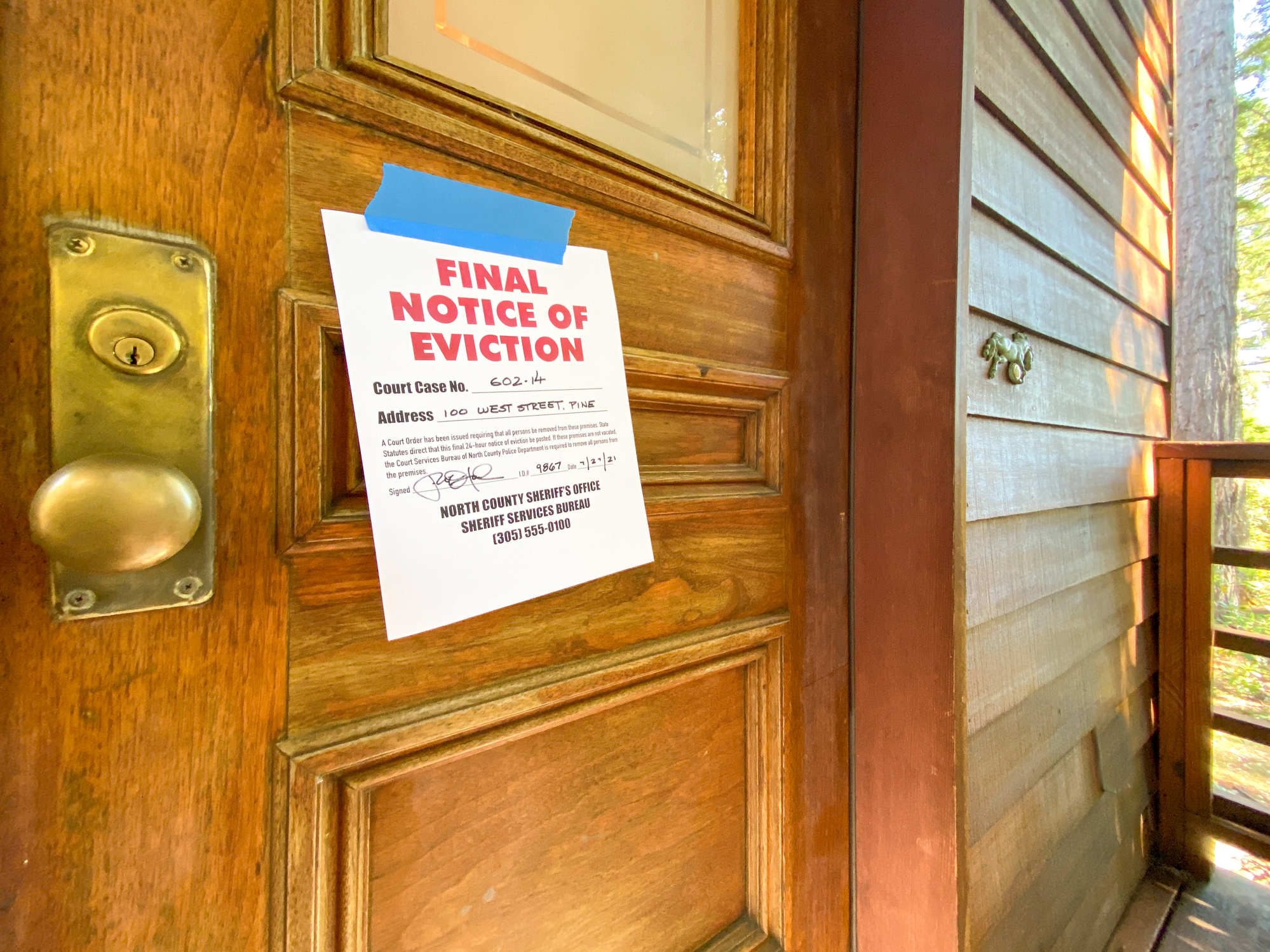

Serious delinquencies are expected to rise — particularly among lower-income households, small business owners and for those working in sectors hard hit by the pandemic.

The U.S. economy added 1.4 million new jobs in August, but one economist warns that permanent job losses are a bigger problem.

Working from home as an ongoing trend will greatly change the landscape of where people buy homes, according to NAR Chief Economist Lawrence Yun.

Along with the resurgence of COVID-19 cases and local shutdowns, mortgage delinquencies are on the rise.

This year’s release of the CREW Network’s benchmark study shows some backsliding in the industry, though there were a few bright spots as well.

CoreLogic’s latest HPI Forecast shows annual home price growth slowing through July 2021, reflecting the anticipated elevated unemployment rates during the next year.