Current Market Data

The National Association of Realtors’ Pending Home Sales Index broke a 17-month streak of year-over-year declines to log an annual increase in June. Last month also marked the second month in a row in which nationwide pending home sales

As housing costs have continued to grow faster than the average buyer’s income, more are tapping into resources that can lower the substantial up-front costs of purchasing a home. But that could bring some major changes and a degree

While sales of previously owned homes continue to underwhelm, housing market analysts are feeling more optimistic about sales of newly-built homes. The U.S. Census Bureau reported new-home sales in June came in at a seasonally adjusted annual rate of

The national existing-home market nearly gave up the ground won in May with a less-than-stellar showing for June sales, according to the National Association of Realtors. Sales of existing homes in June came in 1.7 percent below the previous

The pace of growth in home improvement spending could soon slow to a crawl. That’s according to a new estimate by the Remodeling Futures Program at Harvard’s Joint Center for Housing Studies, which projects that spending on remodeling will

U.S. home sales to foreign buyers declined in the last year compared to the prior period, but still generated nearly $78 billion in total purchase volume between April 2018 and March 2019, according to the National Association of Realtors.

Housing starts around the country were sluggish in June, with single-family starts registering below year-ago numbers for a fifth consecutive month. In all, housing starts were down 0.9 percent from the previous June, and were on pace for a

It’s often said by economists that housing costs have risen faster than wages in recent decades, but just how wide is the gulf between income growth and gains in property values? We now have a better sense of

As 2019 breezes past, the June 2019 report from the Atlanta Realtors Association confirms that at midyear, the Atlanta real estate market is steadily shifting into a neutral territory between a market favoring buyers and one that favors

New data from realtor.com shows that while 42 percent of home shoppers this past spring were first-time buyers, the group, consisting mostly of millennials, had trouble finding homes due to budget constraints — a higher proportion than just two

Weekly mortgage applications fall; activity remains high Mortgage application activity fell during the week ending July 5 compared to the previous week, although overall volume remained above levels seen at the same time last year. The Mortgage Bankers Association’s

Just when many housing markets were seeing some relief in their scant inventory of for-sale housing, there are now fresh signs afoot that supply levels may return to a trend of tightening. A new report on the housing

July marked the second consecutive month of tightening margins between owners’ estimates of home values and the professional opinions of appraisers, according to Quicken Loans’ National Home Price Perception Index. Appraised values were only 0.71 percent lower nationwide than

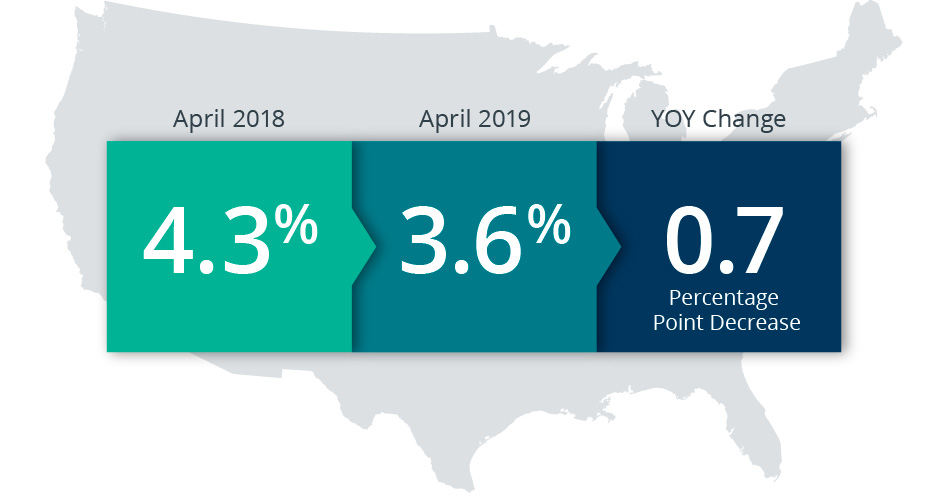

Loan delinquency rates hit their lowest level in 20 years this past April, according to a new report from real estate data firm CoreLogic, showing that American homeowners continue to thrive about a decade after the housing market’s near-collapse. The report

Less than a week after the National Association of Realtors reported stronger than expected existing-home sales for the month of May, there’s more good news for the U.S. housing market. NAR’s Pending Home Sales Index for May came in

In March, the luxury home market saw the largest drop in sales since 2010 with an 8.3 percent year-over-year decrease in closings, according to data gathered by Realtor.com. There were just 8,343 sales in excess of $1 million across