Buying a home remains a goal for many Americans. However, the road to homeownership is rockier for some than for others.

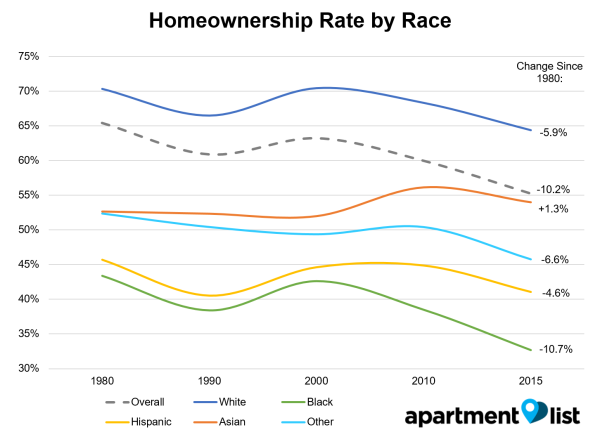

A new Apartment List report reveals that the rate of homeownership in the United States varies greatly by race. The study — which examined national census data from 1980 to 2015 — analyzed the demographics of owner and renter populations ages 25 to 54.

By the numbers, 64.4 percent of white households are homeowners. The same is true for only 54 percent of Asian households, 41.1 percent of Hispanic households and 32.7 percent of black households across the country.

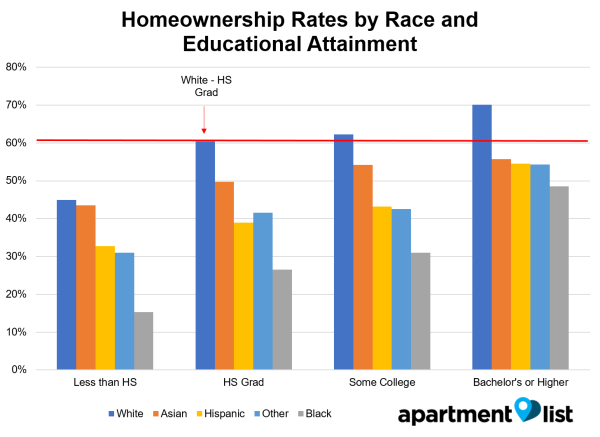

A similar racial disparity exists among homeownership rates even when factors like education and income are taken into consideration.

The report found that white Americans with a high school degree have a higher rate of homeownership than individuals of any minority with a college degree. In contrast, black Americans have the lowest homeownership rates regardless of education level.

Moreover, a black household making less than $25,000 a year has a homeownership rate 2.4 times less than that of white households in the exact same revenue bracket, indicating that income is not at the root of the ownership discrepancy either.

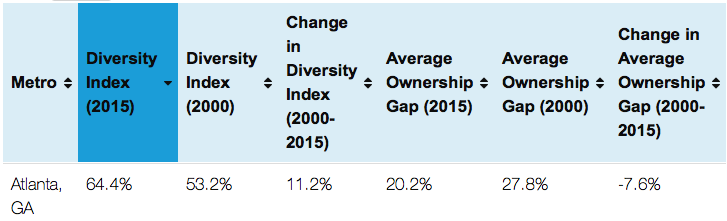

When broken down by city and state, the data suggests that more diverse metros do boast smaller gaps between the homeownership rates of different racial groups.

The city of Atlanta, for example, has a diversity index of 64.4 percent (out of 100) with an average ownership gap of about 20.2 percent. The diversity index measures the probability that two household heads chosen at random are of a different race from each other. San Francisco tops the list at 70.3 percent.

However, a small ownership gap does not necessarily correlate to higher homeownership rates for Atlanta minorities overall. Apartment List makes clear that, while there may be more ownership opportunities for minority populations in racially diverse cities, there is still much to be done to increase their share in the housing market nationwide.