By the Numbers

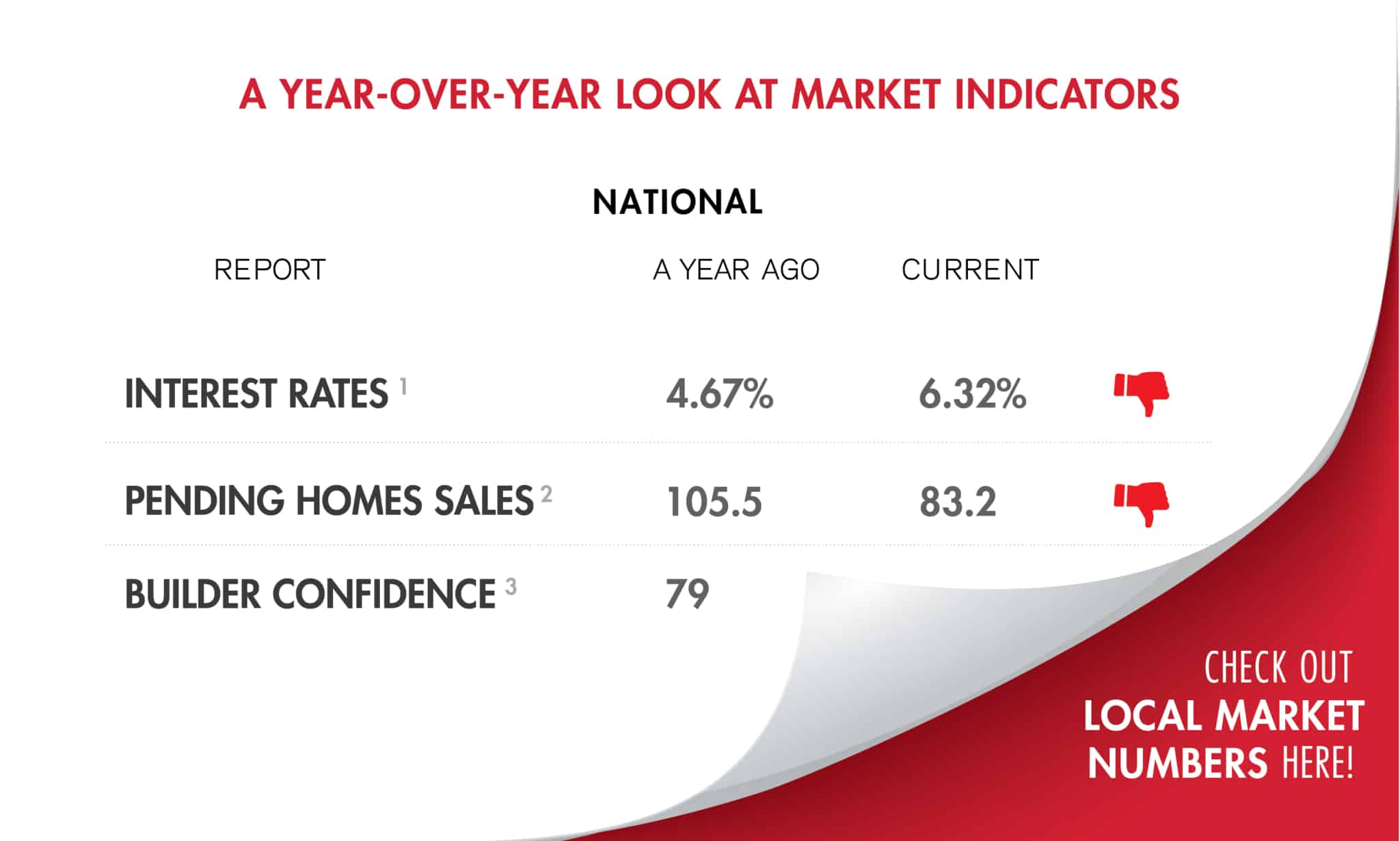

High demand drove multiple offers on about a third of pending sales, while 28% of homes sold above list price, the National Association of REALTORS® reported.

At the same time, home sales dropped 26% year over year in Atlanta, and the median sales price rose 0.5%.

Both Atlanta and the state of Georgia saw healthy annual increases in new residential permits last year, defying a broader nationwide contraction.

U.S. government data shows builders increased the pace of single-family home construction while slowing the pace of multifamily starts.

Data provider MarketNsight said the year-over-year increase stemmed from higher interest rates that have kept existing homeowners from selling.

The National Association of Home Builders/Wells Fargo Housing Market Index rose for the fourth month in a row in April as the construction industry remained “cautiously optimistic.”

At the same time, new listings surged, and the median sales price was flat

This was the fourth week in a row of declines, leaving prospective buyers hopeful for sustained low rates throughout spring homebuying season.

Sales of existing homes declined while the number of days they spent on the market rose, according to the April edition of the Housing Scorecard.

The National Association of REALTORS® Pending Home Sales Index rose for the third month in a row, suggesting the housing market’s contraction could be “coming to an end.”

In Atlanta , home prices rose 8.4% year over year and slid 0.3% month over month.

Total housing inventory rose 39.9% from February 2022 to 9,230 units, while new listings totaled 5,416, Atlanta REALTORS® Association said.

The supply of new homes for sale ticked lower from February, according to government figures.

The annual rate of 4.58 million sales was up 14.5% from January but down 22.6% from the February 2022 rate of 5.92 million.

A shortage of existing-home inventory is driving more people to the market for newly built homes.

Homebuilders expressed “cautious optimism” that the lack of existing inventory would drive demand for new homes despite high construction costs and interest rates, the National Association of Home Builders reported.